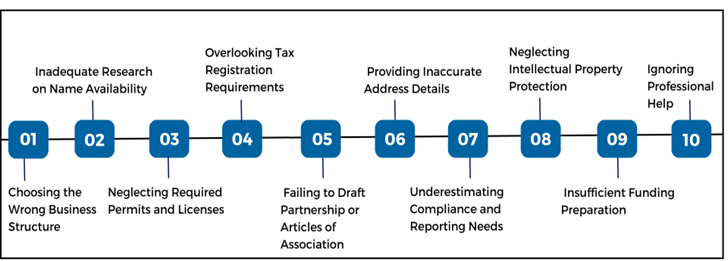

10 Common Mistakes During Company Registration and Methods to Avoid Them

Starting a business is an exciting venture, but the company registration process can be fraught with challenges. Entrepreneurs often face several pitfalls that can lead to delays, penalties, or legal complications. This guide highlights ten common mistakes made during company registration and provides actionable strategies to help you avoid them.

1. Choosing the Wrong Business Structure

Selecting the appropriate business structure (sole proprietorship, partnership, LLP, private limited, or public limited) is crucial. The structure impacts your liability, taxes, and ability to raise capital.

How to Avoid: Assess your business goals and consider consulting with a lawyer or accountant to determine the best option for your situation.

2. Inadequate Research on Name Availability

Your business name is a critical aspect of your brand identity. Failing to check if the desired name is already in use can lead to legal trouble and rebranding efforts.

How to Avoid: Always conduct a thorough name availability check using the Ministry of Corporate Affairs (MCA) portal and perform a trademark search before finalizing your business name.

3. Neglecting Required Permits and Licenses

Different industries and regions require specific licenses and permits to operate legally. Overlooking these can result in fines or even the closure of your business.

How to Avoid: Research the necessary permits for your industry and location. Government websites and professional consultants can provide this information.

4. Overlooking Tax Registration Requirements

It’s essential to register for various taxes (like GST, PAN, and TAN) during the registration process, as failure to do so can lead to penalties.

How to Avoid: Apply for necessary tax registrations simultaneously with your business registration to ensure compliance.

5. Failing to Draft Partnership or Articles of Association

Partnership deeds, articles of association, or similar documents outline the operational and management framework of your business. Lacking these can lead to disputes among partners or shareholders.

How to Avoid: Ensure these documents are drafted clearly, addressing critical aspects of operations and governance. Seeking legal advice during this stage is recommended.

6. Providing Inaccurate Address Details

Incorrect registered office addresses can lead to legal issues and regulatory complications.

How to Avoid: Ensure the address matches official documentation, such as utility bills or lease agreements, and is valid for correspondence.

7. Underestimating Compliance and Reporting Needs

Post-registration compliance is essential, including filing annual returns and maintaining financial records. Neglecting these requirements can lead to penalties.

How to Avoid: Use professional accounting services and maintain a compliance calendar to track important deadlines.

8. Neglecting Intellectual Property Protection

Intellectual property is a valuable asset that needs protection. Failing to safeguard your IP can result in lost revenues and competitive disadvantages.

How to Avoid: Register trademarks, copyrights, and patents as necessary to protect your brand and products.

9. Insufficient Funding Preparation

Many startups fail due to a lack of adequate funding. Entrepreneurs typically underestimate the amounts needed to sustain their business initially.

How to Avoid: Prepare a thorough financial plan and secure enough capital through loans, investors, or personal funds to cover operational costs in the early stages.

10. Ignoring Professional Help

Many entrepreneurs try to manage the registration process independently, which may lead to costly mistakes.

How to Avoid: Engaging with professional advisors can save you time and prevent legal challenges down the line.

Conclusion

Company registration is a critical step in establishing a successful business, but it comes with challenges that can impact your operations if not handled carefully. By avoiding common mistakes such as choosing the wrong structure, neglecting compliance requirements, and skipping professional guidance, you can ensure a smoother registration process. Taking the time to research, plan, and seek expert advice will not only save time and resources but also set a strong foundation for your business’s growth and success.

Advanced FAQs on Company Registration

1. Can I change my business structure after registration?

Yes, it’s possible to change your business structure, but the process can be complex. For example, converting from a sole proprietorship to a Private Limited Company requires additional compliance with tax regulations and legal formalities. It’s advisable to consult a legal professional during this transition.

2. How often do I need to file annual returns, and what happens if I miss the deadline?

Companies must file annual returns and financial statements with the registrar every financial year. Missing the deadline can result in penalties, and continual non-compliance may lead to the company being struck off the register.

3. How do I choose a suitable name for my company that complies with legal regulations?

Choosing a company name involves ensuring it’s unique and does not resemble existing businesses. You must cross-check with the MCA portal for availability and review the Companies Act guidelines. Avoid using words that are prohibited or require government approval, and ensure your name is not misleading.

4. What documents are essential for the incorporation of a Private Limited Company?

Key documents include the Memorandum of Association (MoA), Articles of Association (AoA), identity and address proofs of directors and shareholders, a registered office address proof, and the Digital Signature Certificate (DSC). Additional documents may vary based on specific regulatory requirements.

5. Do I need a registered office for my business? What should it entail?

Yes, every registered company must have a registered office, which serves as the official correspondence address. The registered office must have adequate space for documentation and should be backed by proof of ownership or lease, along with a No Objection Certificate (NOC) if applicable.

6. How can I ensure compliance with labor laws after registration?

Post-registration, businesses must comply with various labor laws depending on the number of employees, industry, and location. Regular HR audits, maintaining payroll records, timely payment of salaries, and adhering to workplace health and safety regulations are essential to remain compliant.

7. Can I register a company without a physical office?

While a registered office is a legal requirement, some entrepreneurs may use a virtual office service for registration. However, it’s vital to ensure that the location complies with all legal requirements, and you have a valid arrangement with the service provider.