All About Hindu Undivided Family (HUF)

What is a HUF?

HUF means Hindu Undivided Family. You can save taxes by forming a family group and pooling assets into a HUF. HUFs are taxed separately from their members. A Hindu family can jointly form a HUF. Buddhists, Jains and Sikhs can form HUFs. HUF has its own PAN and free tax returns from members.

History of HUF:

HUFs got legal recognition in the late 19th century, but it was the Taxation Act under the colonial rule of 1922 that gave it the status as a separate and distinct tax corporation and HUFs have been a legal entity for tax purposes of the law since then.

HUF Tax Benefits

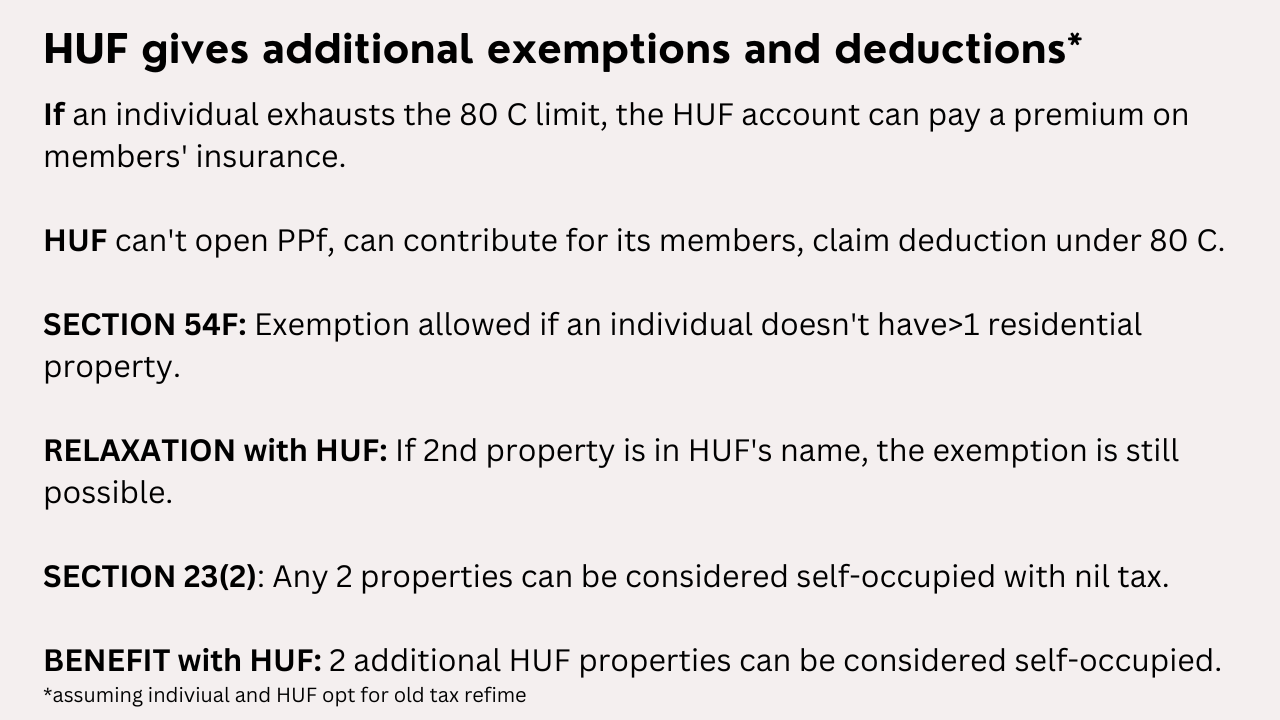

Tax benefits are one of the major HUF benefits. These contain:

- Tax deduction can be availed under Section 80C for HUF account.

- Gifts up to worth Rs 50,000 will be tax-free. A father who retains a HUF account can gift a property or money of higher worth to a son who owns a smaller HUF account. The gift should exactly be for the son’s HUF. In such cases, tax benefits are available under sections 64(2) and 56(2).

- The corpus can be cashed in tax-free cash machines.

How to Save Taxes by Building A HUF?

The main reason to build a HUF is to get an additional PAN card that’s legally accepted and can be used for tax benefits. After the HUF is built, those under it won’t have to worry about paying taxes individually. And as soon as the new HUF PAN card is made, the family can start paying their taxes themselves.

The family will then use this new PAN card to file the ITR. If their annual income surpasses the limit, they’ll receive a 10%, 20%, and 30% tax based on their slab of income.

Now let’s put all together with an example:

Let’s say a family has four members: a husband, wife, and two kids. The husband makes Rs 20 lakh per year while the wife makes Rs 16 lakh per year. On top of that, they make around Rs 6 lakh from renting out land that’s been in their family for generations.

If you take all of their incomes separately and compare them to making money from ancestral lands — there might be some form of weird tax rule that’ll come with it. Now let’s see how it works:

- If the husband is taxed, he now falls below 30% of the income tax bracket. So he would end up paying 30% on Rs 6 lakh which would be Rs 1.8 lakh as tax amount.

- If the wife is taxed, as she also falls below 30% in the income tax bracket, she will end up paying Rs. 6 lakh of Rs. 1.8 lakh as tax rate.

- If both husband and wife are taxed equally, they would have to pay 30% each of Rs 6 lakh. Ultimately, that means a joint payment of Rs. 90,000 + Rs. 90,000 = Rs. 1,80,000 respectively

- However, one can avail additional tax benefits for acquiring land under HUF. For HUF member, the tax would be reduced to Rs. 60,000 to 70,000. That means you can save around Rs 1,80,000- Rs 60,000=in taxes. 1,20,000 respectively.

How HUF works?

How to form or create HUF

Here are three simple steps to create a HUF:

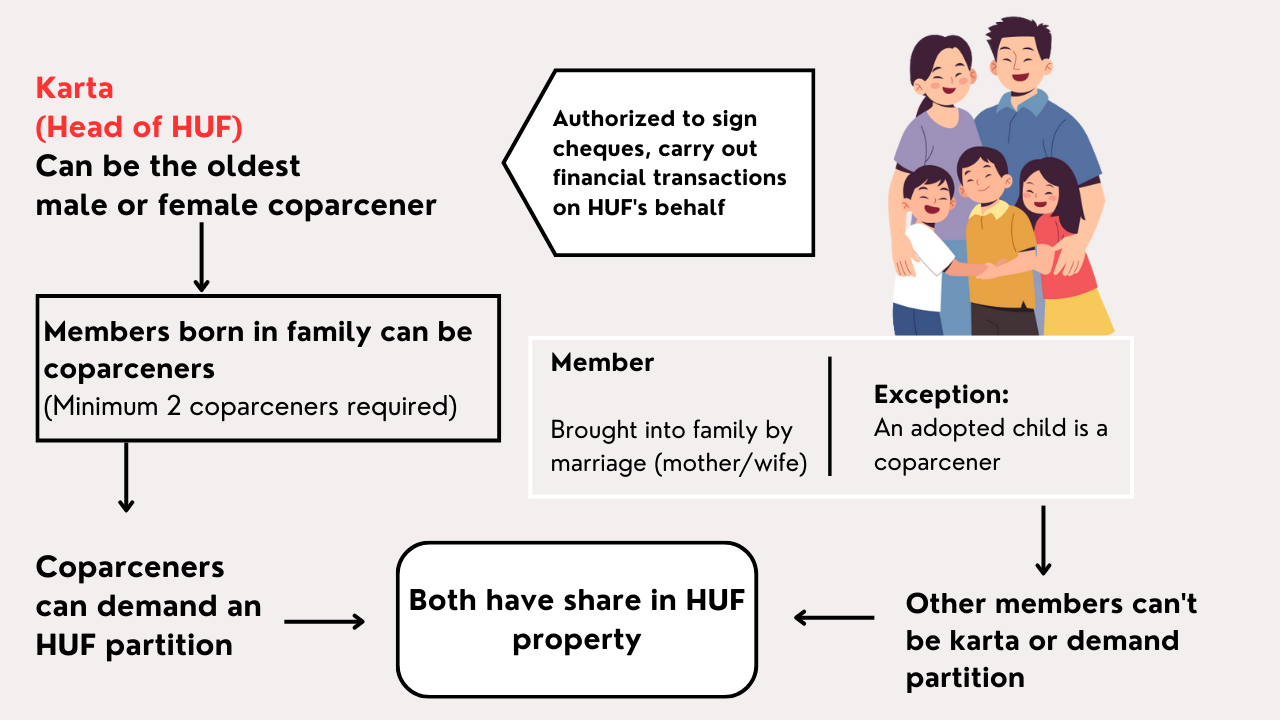

Step 1: Prepare a HUF Deed Prepare a HUF Deed, which is a document outline the rules and guidelines of the HUF. It should include details of Karta, partners and other family members.

Step 2: Apply HUF PAN Card Apply a copy to the Income Tax Department and get a PAN (permanent account number) card for HUF. PAN card is required for financial transactions and filing of tax returns on behalf of HUFs.

Step 3: Open bank account for HUF Open a dedicated bank account in the name of HUF. These accounts will be treated separately from the accounts of individual members for managing the financial transactions and funds of the HUF.

Once this step is taken, the HUF becomes a separate legal entity. He can earn wages and hold property in his name. It is important to note that any income received by an HUF is taxed separately and is not imposed on individual members of the HUF.

The table below is a list of various factors relating to the formation and structure of a Hindu Undivided Family (HUF).

| Family Formation | HUF cannot be formed by an individual; it can only be created by a family unit. |

| Automatic Creation | HUF is automatically formed at the time of marriage. |

| HUF Composition | HUFs have a common ancestor and all their descendants, including spouses and unmarried daughters. |

| Eligible Communities | Hindus, Buddhists, Jains, and Sikhs are eligible to form HUFs. |

| Assets of HUF

|

Generally, HUFs hold assets acquired through gifts, bequests, ancestral property, sale of joint family assets, or contributions to the common pool by HUF members |

| Formal Registration | Once formed, the HUF must be formally registered in its name. This involves the preparation of a statutory document containing the details of the members of the HUF and the business activities of the HUF. |

| PAN and Bank Account | The HUF should obtain a PAN number and open a dedicated bank account in the name of the HUF. |

Disadvantage of forming an HUF

While HUF may seem like a perfect way to save on taxes as a family, it comes with its drawbacks.

Equal rights of members: The major disadvantage of opening a HUF is that its members have equal rights over the property. Mutual property cannot be sold lacking the consent of all members. Any change in the family, either by birth or marriage, becomes a member of the HUF and discusses the same rights. One HUF may be too large to handle.

Partition: Maybe the worst terrible of opening a HUF is closing it. The only way to destroy the HUF is by partitioning it. All members must agree to dissolve the HUF. Under separation, property is distributed among members which can cause a lot of controversy and a lot of legal problems.

Joint family system losing relevance: HUF was recognized as a separate taxable entity by the Income Tax Department. But today, where nuclear families are common, HUFs are losing their importance. There have been many cases where couples or families are fighting over common household expenses, forget about accumulated assets. Divorce rates are increasing and hence, HUF is losing its importance as a tax vehicle.

The HUF is treated in the same way till the partition: once the HUF is created, you have to continue filing its tax returns, till the partition takes place. Any claim for partition shall be referred to the Assessing Officer. The Assessing Officer, on receipt of such, is entitled to make an inquiry by giving due notice to the members. Income from the distribution of property is taxed as personal income for the member. If the member forms a new HUF with his/her spouse and children, the income from the assets transferred from the original HUF is taxable in the hands of the new HUF.

HUF Account Rules?

One of the important reasons for setting up HUFs is to get additional tax benefits. Before doing so, however, one should know the policies and procedures required to set up a HUF. Below are few rules of HUF account:

- HUF should be formed only by the family.

- The HUF is automatically created for the new addition of the family member at the time of marriage.

- A HUF usually has one grandfather and all his descendants and their daughters and spouses.

- Buddhists, Hindus, Sikhs and Jains can build HUFs.

- HUFs usually have assets that come in the form of bequests, gifts or bequests.

- Once the HUF is formed, a bank account should be created in the name of the HUF. Then, a PAN number is generated in the name of the HUF.

- Each member of the family can contribute his income to the common corpus.

- Tax benefits are applied to investments under sections.

- The corpus can be divided only with the consent of each family member.

HUF Advantages and Disadvantages

There are many advantages and disadvantages of HUF, some of which are discussed below.

Advantages of HUF:

- Like other individuals, HUF members have to pay taxes every year. If the business income of the HUF member exceeds Rs.25 lakhs or Rs. 1 crore requires a tax audit under the guidance of a certified chartered accountant as mentioned in Section 44AB of the Income Tax Act.

- The HUF chapter has every right to sign the relevant documents for other family members. They also have permission for another older family member to perform the duties.

- The adopted child can also be a member of the HUF.

- HUF is recognized all over India except Kerala.

- One of the main reasons for families forming HUFs is that it helps them create duplicate PAN cards and file tax returns separately.

- HUF members can avail the loan easily.

Disadvantages of HUF:

- One of the major disadvantages of HUFs is that every family member has equal rights in every family asset. Joint property cannot be sold without the consent of all family members. In addition, family size increases in births and marriages.

- Closing a HUF is much harder than opening or folding a HUF. Splitting the family into small groups could lead to the breakdown of the HUF. The closure of a HUF involves distribution of family assets among all the family members, which is sometimes very difficult to manage. In addition, legal trouble creates new problems for him.

- HUF is a separate tax entity in the Income Tax Department. But today’s blended families are increasingly losing their importance and relevance. These days, there are many cases where HUFs are fighting over petty issues or property. Moreover, it is noted that divorce cases are increasing every day. For all these reasons, HUF is losing its utility as a tax saving instrument.

Illustration of HUF

Suppose a person, Mr. X, decides to start a HUF after the death of his father with his wife, son & daughter. Since Mr. X has no siblings, his father’s estate was transferred under HUF.

Now if the annual rent on his father’s property is Rs.7.5 lakhs and the salary income of Mr. X is Rs 20 lakhs, he can save tax as under:

| Income from different sources | Income of Mr. X before creating HUF | Income of Mr. X after creating HUF | HUF Income | |

| Salary | Rs. 20 lakhs | Rs. 20 lakhs | – | |

| Property rent | Rs. 7.5 lakhs | – | Rs. 7.5 lakhs | |

| Standard deduction on the property | Rs. 2.25 lakhs | – | Rs. 2.25 lakhs | |

| Income from Property | Rs. 5.25 lakhs | – | Rs. 5.25 lakhs | |

| Total taxable income | Rs. 25.25 lakhs | Rs. 20 lakhs | Rs. 5.25 lakhs | |

| Section 80C | Rs. 1.5 lakhs | Rs. 1.5 lakhs | Rs. 1.5 lakhs | |

| Net taxable income | Rs. 23.75 lakhs | Rs. 18.5 lakhs | Rs. 3.75 lakhs | |

| Tax payable | Rs. 5,46,000 | Rs. 3,82,200 | Rs. 6,500 | |

| Total tax paid by Mr. X & HUF | Rs. 3,88,700 | |||

| Tax savings after creating HUF | Rs 1,57,300 | |||

Both Mr. X and the HUF (including other members of HUF) can claim tax deduction u/s 80C.