Clarification regarding transfer of Input Tax credit in case of “Death of sole proprietor”

A registered Taxpayer can apply for transfer of Matched Input tax credit that is available in the Electronic credit ledger of taxpayer to another business/another registered taxpayer in case of transfer of business by way of merger/demerger/sale of business by filling of ITC declaration in FORM GST ITC‐02.

But some doubts had been raised about the transfer of credit specially in the case of death of Sole Proprietor for which clarification has been asked, which are as follows:‐

1. Whether transfer of business due to “Death of Sole Proprietor” includes in the meaning of “transfer of business” for the sake of transfer of unutilized Input Tax credit to transferee of business.

2. Further clarification has also been sought for procedure regarding filling of Form GST ITC‐02 in case of death of the Sole proprietor.

Government has issued Clarification through Circular No.‐96/15/2019‐GST on 28th of March, 2019.

Clarification for Point‐1:‐Transfer of Business due to “Death of Sole Proprietor” includes in the reason for Transfer of business for the sake of transfer of unutilized Input Tax credit to transferee of business?

Clause (a) of Subsection 1 of Section 29 provides the reason for transfer of business which includes:‐

- Death of Proprietor,

- Amalgamated with Other legal entity,

- demerged or

- Otherwise disposed off

As mentioned above Reason for Transfer of business clearly includes “Death of Sole proprietor”. Therefore, Unutilized Matched Input tax Credit of Registered Taxpayer can be transferred to another registered entity for the reason of “Death of Sole Proprietor”.

Conditions to be fulfilled for the transfer of Input tax credit to another registered entity due to change in ownership of business:‐

- In case of registered person undergoes sale, merger, de‐merger, Amalgamation, Lease or transfer, the institution or organization, must file an ITC declaration for transfer of ITC in Form GST ITC‐02

- The Transferor institution had matched the Unutilized amount of ITC in Electronic credit ledger

- The Transferee and Transferor both should be Registered Taxpayer under GST

- Transferor Must file all the GST returns of past periods

- All the pending transactions for the action of merging should either be accepted, rejected or modified and all liabilities of the returns filed by the transferor must be paid

- The transfer of business has to be with an accurate provision of transfer of liabilities which will be the stayed demands of tax, or with any litigation /recovery cases. It has to be accompanied by the certificate that is issued by the Chartered Accountant or Cost Accountant

Clarification for Point 2:‐Procedure for filling Form GST ITC‐02 in case of “Death of Sole Prioprietor”

`In case of death of sole proprietor, if the business is continued by any other person being the transferee/Successor, the unutilized ITC amount remains in the electronic credit ledger shall be transferred to the transferee as per the provisions and manner stated below:‐

- Registration of Transferor/Successor: ‐

Transferor/Successor shall be liable to be registered with effect from the date of such transfer or Succession, where a business is transferred to another person for any reasons including death of proprietor. In other word while filling the Form GST REG‐1 electronically on common portal (www.gst.gov.in) the applicant is required to mention the reason to obtain registration as “death of the proprietor”. - Cancellation of registration on account of death of proprietor:‐The legal heirs of the deceased sole proprietor is allowed to file FORM GST REG‐16(form for cancellation of registration) electronically on common portal on account of transfer of Business for reason of death of proprietor. While filling FORM GST REG‐16 following need to be mentioned

- – reason for cancellation as Death of the proprietor

- – The GSTIN of the transferee to whom the business has been transferred, to link the GSTIN of the transferee with The GSTIN of theTransferor

- Transfer of Input Tax credit along with the liability:‐ It is clarified in the circular that the transferee / successor shall be liable to pay any tax, interest or any penalty due from the transferor in cases of transfer of business due to death of sole proprietor.

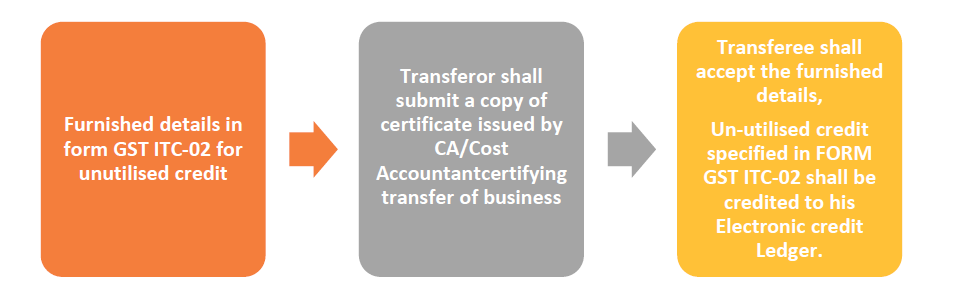

- Manner of Transfer of Credit: In case of Transfer of business on account of “Death of Sole Proprietor” Following will be the procedure:‐

1. The transferee / successor shall file FORM GST ITC‐02 in respect of the registration which is required to be cancelled on account of death of the sole proprietor

2. FORM GST ITC‐02 is required to be filed by the transferee/successor before filing the application for cancellation of such registration

3. Upon acceptance by the transferee / successor, the un‐utilized input tax credit specified in FORM GST ITC‐02 shall be credited to his electronic credit ledger.

For any query Click here.