Do you know it takes a test also to become Independent Director

The Ministry of Corporate Affairs (MCA) through a notification dated 18th December 2020, relaxed both the requirements and timelines for the Online Self-Assessment Proficiency Test Independent Directors must take under the amended Companies (Appointment and Qualification of Directors) Rules, 2014.

Passing the Online Test was a prerequisite for every individual to pass for their name to be included in the Independent Director’s Databank. MCA has authorized ‘Indian Institute of Corporate Affairs (IICA)’ for the creation and maintenance of the databank in compliance of Section 150 of the Companies Act, 2013.

Features of the Test

The test is based on all the relevant topics on the functioning of an individual acting as an Independent Director, such as:

Process of the Test

Individuals empaneled in the Independent Director’s Databank will have to follow the below steps for attempting the Online Proficiency Self-Assessment Test:

In order to take the Online Proficiency test, there are 3 slots to choose from on any given day:

Morning 8:00 AM to 9:00 AM

Afternoon 2:00 PM to 3:00 PM

Evening 8:00 PM to 9:00 PM

Online Proficiency Self-Assessment Test was made available from 1st March 2020 on the online portal maintained by IICA, the slots for which can be booked after successful registration. One can also take the Mock test to familiarize themselves with the test environment and also check the system requirements for the test.

Rules of the Self-Assessment Test

- An individual who has obtained a score of not less than 50% in aggregate (earlier was 60%) in the test shall be deemed to have passed such test.

- Every individual whose name is included in the databank shall be required to pass the test within 2 years (earlier was 1 year) from the date of inclusion of his name in the databank, failing which his name shall stand removed from the databank.

- There shall be no limit on the number of attempts an individual may take for passing the test.

Who is not required to take the test ?

An individual who, as on the date of inclusion of his name in the databank, has served for a period of minimum 3 years:

1. As a director or Key managerial personnel in one or more of the following:

- Listed public company

- Unlisted public company having a paid-up share capital of ₹ 10 crore or more

- Body corporate listed on any recognized stock exchange or in a country which is a member State of the Financial Action Task Force on Money Laundering and the regulator of the securities market in such member State is a member of the International Organization of Securities Commissions

- Bodies corporate incorporated outside India having a paid-up share capital of US$ 2 million or more

- Statutory corporations set up under an Act of Parliament or any State Legislature carrying on commercial activities

2. In the pay scale of Director or above in the Ministry of Corporate Affairs or the Ministry of Finance or Ministry of Commerce and Industry or the Ministry of Heavy Industries and Public Enterprises and having experience in handling the matters relating to corporate laws or securities laws or economic laws

3. in the pay scale of Chief General Manager or above in the SEBI or RBI or IRDAI or the Pension Fund Regulatory and Development Authority and having experience in handling matters relating to corporate laws or securities laws or economic laws.

For the purpose of calculation of the period of three years referred above, any period during which an individual was acting as a director or as a KMP in two or more companies or body corporates or statutory corporations at the same time shall be counted only once.

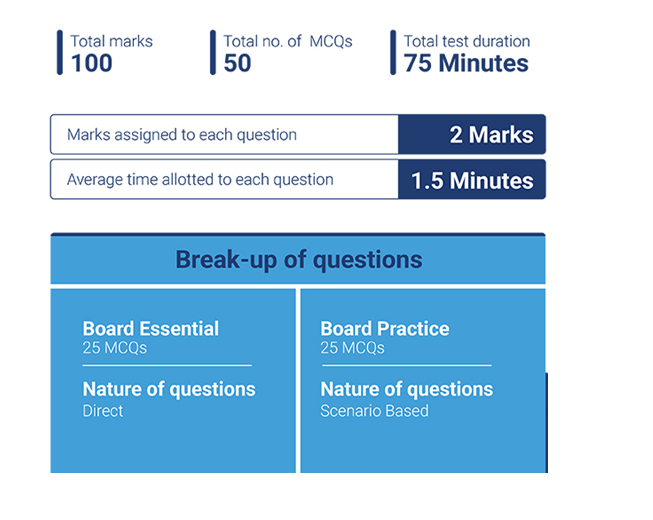

An overview of the Scheme of the test