Form DPT-3

The DPT 3 is a Return of Deposits that companies are required to submit in order to provide information on deposits and/or unpaid loan or other types of money other than deposits.

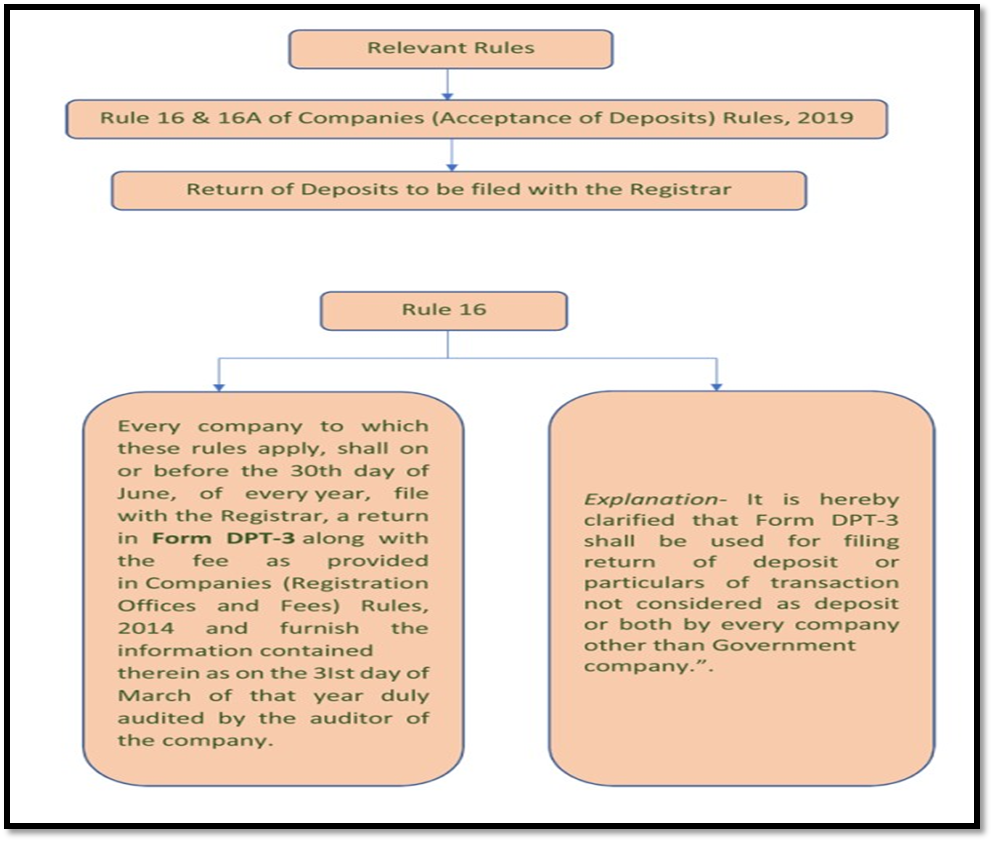

According to Rule 16 of the Companies (Acceptance of Deposits) Rules, 2014,

- Every company to which these rules apply

- is required to file a return of deposits or

- Particulars of transaction not considered as deposit or both in Form DPT-3 with the Registrar

- on or before the 30th June of every year, along with any applicable fees, and

- to provide the information (duly audited) as of the last day of the F.Y., i.e. the 31st day of March.

NIL Return

There is no requirement of filing Nil return.

DPT-3 is a Non STP form, which means that it needs approval of RO.

Who is exempt from filing the return?

The only exception to this filing requirement is government-owned businesses. The following businesses are further excluded pursuant to Rule 1(3) of the Companies (Acceptance of Deposits) Rules 2014:

- Banking Company

- Non- Banking Financial Company

- A Housing Finance Company registered with National Housing Bank.

- Any other company as notified under proviso to sub section (1) to section 73 of the Act.

Transactions not consider as deposit

- Any sum received or guaranteed by the government, foreign government/foreign bank.

- Any loan or facility acquired from a public financial institution, insurance company, or bank

- Any sum received by a firm from another corporation.

- Securities subscription and call in advance.

- Any sum received from the company’s director or a relative of the company’s director who held the positions at the time of lending.

- Any money collected by the firm from an employee that does not exceed his yearly wage as specified in his work contract, such as a non-interest bearing security deposit.

- Any money received as an advance for the supply of goods or provision of services or as a security deposit for the fulfilment of the contract for the supply of goods or provision of services in the course of or for the purposes of the company’s activity.

- A startup firm receiving Rs.25 lakh or more in the form of a convertible note in a single tranche.

- Amount raised by issuing secured bonds or debentures with first charge, non-convertible debentures with no charge on the company’s assets.

- Promoters’ unsecured loans.

- Any sum received by the corporation from Nidhi Corporation or as a subscription for chit under the Chit Funds Act, 1982.

- Any cash received by the firm from a SEBI-registered collective investment plan, alternative investment funds, or mutual funds.

- Any other money that does not qualify as a deposit under Rule 2(1)(c).

As a result, any sum, whether secured or unsecured, that is outstanding money or a loan that is not deemed a deposit.

Information to be Furnished & Documents to be Submitted:

| Sr. No. | Field Name | Private Company | Public Company |

| 1 | Corporate Identity Number (CIN) | Applicable | Applicable |

| 2 | Name of the company | Applicable | Applicable |

| 3 | Registered office address | Applicable | Applicable |

| 4 | Email id | Applicable | Applicable |

| 5 | Purpose of the form: – Select the purpose of the filing the form as applicable:

| Applicable | Applicable |

| 6 | Whether company is a Private company or Public company | Applicable | Applicable |

| 7 | Whether company is a government company | Applicable | Applicable |

| 8 | Whether deposits have been accepted from public? | Not Applicable | Applicable |

| 9 | Net worth as per latest audited balance sheet preceding the date of the return. | Applicable | Applicable |

| 10 | Date of last closing of Accounts | Applicable | Applicable |

| 11 | Date of issue of advertisement or circular | Not Applicable | Applicable |

| 12 | Date of expiry of validity of advertisement or circular | Not Applicable | Applicable |

| 13 | Total no. of deposit holders as on 1st April | Not Applicable | Applicable |

| 14 | Total no of deposit holders at the end of Financial year | Not Applicable | Applicable |

| 15 | Amount of deposits that have been matured but not claimed | Not Applicable | Applicable |

| 16 | Amount of deposits that have been matured claimed but not paid. | Not Applicable | Applicable |

| 17 | Amount of deposit maturing on or before 31st march next year and following next year. | Not Applicable | Applicable |

| 18 | SRN of CHG -1/CHG -9 filed for creation of charge. | Not Applicable | Applicable |

| 19 | Name of the agency, Date of obtaining credit rating. | Not Applicable | Applicable |

The following documents are required to be Submitted when company has accepted the deposits: –

- Auditor’s Certificate

- Copy of Trust deed

- Deposit Insurance Contract, wherever applicable and mentioned in the form

- Copy of Instrument creating the charge.

- List of Depositors- List of deposits matured and cheque issued but not yet cleared to be shown separately

- Details of liquid assets

- Optional attachment

Normal filing fees

In case of company having Share Capital

| Sr. No | Nominal Share Capital (INR) | Fee Applicable (INR) |

| 1 | Less than 1,00,000 | 200 |

| 2 | 1,00,000 to 4,99,999 | 300 |

| 3 | 5,00,000 to 24,99,999 | 400 |

| 4 | 25,00,000 to 99,99,999 | 500 |

| 5 | 1,00,00,000 or more | 600 |

In case company not having share capital

Normal fee applicable (INR) 200

Additional fees in case of delay in filing of webforms.

| Sr. no. | Period of Delay | Additional fees applicable (INR) |

| 1 | Upto 30 days | 2 times of normal filing fees |

| 2 | More than 30days and upto 60 days | 4 times of normal filing fees |

| 3 | More than 60 days and upto 90 days | 6 times of normal filing fees |

| 4 | More than 90 days and upto 180 days | 10 times of normal filing fees |

| 5 | More than 180 days | 12 times of normal filing fees |

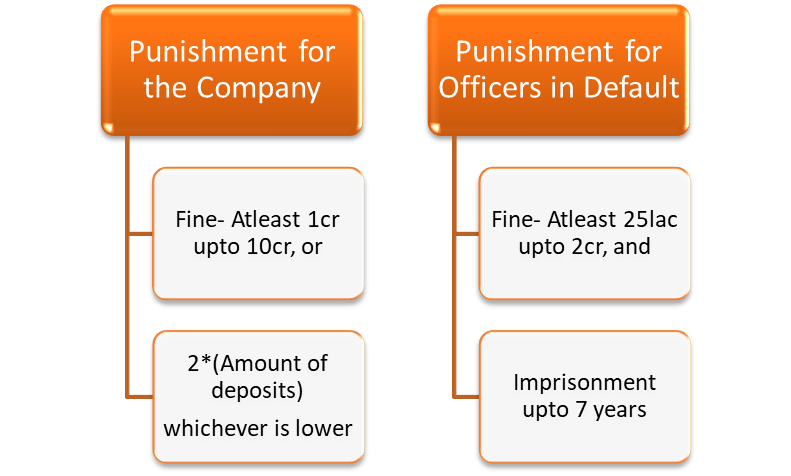

Consequences of Non- Filing

The firm may experience the following consequences if it disregards the DPT-3 criteria and continues to accept deposits:

- Under Section 73: A fine of at least Rs.1 crore upto Rs.10 crore, or double the amount of deposits, whichever is lower.

- For any officer who is in default, punishments of upto 7 years in jail and fines starting at atleast Rs.25 lakh but upto Rs. 2 crore are possible.

If you have any questions to wish to know more about “Form DPT-3”, kindly Contact us.