Real Estate Investment Trust

What is a real estate investment?

If you’re search into the world of investments beyond traditional stocks and mutual funds, you’ve likely come across the term REIT (Real Estate Investment Trusts). But what exactly constitutes a real estate investment, and how does it operate?

In essence, a real estate investment trust, often reduce as a REIT (rhyming with “sweet”), is a specialized company that revolves around income-generating real estate. Think of it as a vehicle for everyday individuals to tap into the realm of real estate without the intricacies of directly purchasing, managing, or funding properties themselves.

REITs emulate the structure of mutual funds, pooling the capital of numerous investors. This collective approach enables investors to partake in the profitability of valuable real estate assets, which encompass office buildings, shopping malls, apartments, hotels, self-storage facilities, and a myriad of other income-yielding properties. The appeal of REITs lies in their capacity to provide access to dividend-based income and overall returns while simultaneously contributing to community growth and prosperity.

When you invest in a REIT, you are essentially acquiring a stake in the enterprise. Your investment becomes a part of a diversified portfolio of real estate assets diligently managed by the REIT company. The revenue generated from these assets, including rental income collected from tenants, is disseminated among shareholders in the form of income and dividends.

One of the most notable benefits of REITs is their accessibility. They cater to both large and small investors alike. Smaller investors even have the opportunity to collaborate with others to collectively invest in substantial commercial real estate endeavors through REITs. The spectrum of properties encompassed within REIT portfolios is extensive, spanning data centers, infrastructure, healthcare facilities, apartment complexes, and more.

The inception of the REIT concept can be traced back to the United States in the 1960s, with the primary objective of affording investors the chance to profit from professionally managed real estate portfolios. These trusts share similarities with mutual funds in that they amalgamate investments and are overseen by professional managers. However, unlike mutual funds that predominantly invest in equities, debt, or precious metals, REITs place a distinct emphasis on real estate holdings and loans backed by real estate.

How Real Estate Investment Trusts (REITs) Work

Money from various investors is combined to invest in commercial properties that generate revenue, and such investments are much like mutual funds. Simply put, real estate investment trusts, or REITs, are similar to mutual funds in that they both permit buying units in the said investment vehicle. The revenue received from the properties is divided among investors for mutual benefit.

In India, REITs have the opportunity to be listed on stock exchanges through the IPO method. By investing in REITs, earning money from real estate investments is made possible without owning property.

Types of Real Estate Investment Trusts

To get a better classification of REITs, we must look at the types of businesses they are involved with. The classifications can also be aided by the purchasing and selling methods devised for REITs.

Different types of REITs are listed below.

Equity: Income-generating commercial properties are the primary focus of one of the most prevalent REITs, equity. This type of REIT is responsible for both operating and managing such properties. The predominant source of revenue for equity REITs is, unsurprisingly, rent.

Mortgage: Facilitating mortgages is the main function of mREITs, or Mortgage Real Estate Investment Trusts. In addition, they acquire securities that are backed by mortgages. The interest earned on their loans to proprietors is what generates income for mortgage REITs.

Hybrid: By choosing the hybrid option, investors can create a diversified portfolio incorporating both equity REITs and mortgage REITs. With this option, rental income and interest both contribute to the sources of revenue for this specific type of REIT.

Private REITs: Private REITs operate as private placements for a select list of investors only. Generally, private REITs are neither traded on the national stock exchange nor registered with SEBI.

Publicly traded REITs: Typically, publicly traded REITs issue shares that are listed on the national stock exchange and regulated by SEBI. Individual investors can buy and sell such shares through the NSE.

Public non-traded REITs: A public unlisted REIT is an unlisted REIT registered with SEBI. However, they are not traded on national stock exchanges. Additionally, these options are less liquid than public, unlisted REITs. They are also more stable because they are not affected by market fluctuations.

Because REITs own and manage high-quality real estate, they are one of the most expensive investment options. Therefore, an investor who puts money into a REIT is an investor with a substantial amount of capital. For example, large institutional investors such as insurance companies, endowment funds, bank trust departments, pension funds, etc. can appropriately invest in these financial instruments.

Role of REITs in a Retirement Portfolio :- It turns out that adding REITs to your retirement portfolio can be an investment in a number of ways. The following tips will help you gain valuable insight into this:

Exposes its portfolio to a diverse mix of properties :- By incorporating real estate into the mix, you can significantly diversify into other asset classes without having to manage them yourself. Additionally, price fluctuations in other investment options will not affect REITs if they are diversified. Conversely, it’s fair to say that REITs don’t drop in value as quickly as stocks when the market falls.

Opportunity to generate earnings

When REITs increase in value, investors tend to earn handsome returns. Additionally, these companies are required to distribute up to 90% of taxable profits to shareholders in order to maintain a steady stream of income.

Suitable for long-term

Unlike stocks and bonds, which follow a six-time profitable cycle, REITs follow movements in the casing request more closely. It’s worth noting that similar moves generally take more than a decade to complete, making them more suitable for investors with a long-term investment horizon. It turned out to be a smart investment opportunity for withdrawal planning.

Helps hedge against inflation

Exploration shows that REITs allow investors to hedge against the effects of inflation over the long term. For illustration, investors can more effectively cover their money against inflation with a five-year investment horizon than with stock options.

Individuals can buy stock in a REIT, which is listed on a major exchange like any other public stock. Investors can also buy shares in REIT collective finances or exchange-traded funds finances( ETFs).

A broker, investment counsel, or fiscal diary can help dissect an investor’s fiscal pretensions and recommend applicable REIT investments.

Investors also have the option of investing in unrecorded public REITs and private REITs.

Advantages and disadvantages of REITs

Advantages:

Steady dividend income and capital appreciation: Investing in REITs is expected to generate healthy dividend income while also allowing for long-term steady capital growth.

Option to diversify: Since most REITs are frequently traded on exchanges, it offers investors the opportunity to diversify their properties.

Transparency in dealing: Under SEBI regulation, REITs are required to submit peer-reviewed fiscal reports. It provides investors with access to information on taxation, power, and zoning, making the entire process transparent.

Liquidity: Most REITs are traded on public exchanges, making them easy to buy and sell, further adding to their liquidity.

Accrues risk-adjusted returns: Investing in REITs can provide individuals with threat-acclimated returns and help induce steady cash inflow. They can indeed have a steady stream of income with high affectation.

Disadvantages:

No tax benefits: When it comes to duty savings, REITs do not do much. For illustration, REIT tips are taxable.

Market-linked risks: One of the biggest pitfalls for REITs is their vulnerability to request volatility. To this end, investors with weak risk forbearance should weigh the pros and cons. Know in advance the profitability of this investment.

Low growth prospects: REITs have fairly low capital appreciation prospects. This is substantial because they give back and reinvest up to 90% of their income back to their investors. Only the remaining 10 go to their companies.

The following list outlines the Pros and Cons of investing in top Real Estate Investment Trusts (REITs):

| Pros | Cons |

| Liquidity | Lack of tax benefits |

| Option to diversify | Market risk |

| Transparent | Low growth prospect |

| Risk-adjusted returns | High maintenance fee |

| Steady dividend income | Other additional charges |

Be wary of those trying to sell REITs that are not registered with the SEC.

You can verify the registration of public and untraded REITs through the SEC’s EDGAR system. You can also use EDGAR to view a REIT’s annual and quarterly reports, as well as any offering circulars. For more information on using EDGAR, see Researching Public Companies.

You should also contact a broker or investment advisor who recommends buying REITs. See Working with Brokers and Investment Advisors for more information.

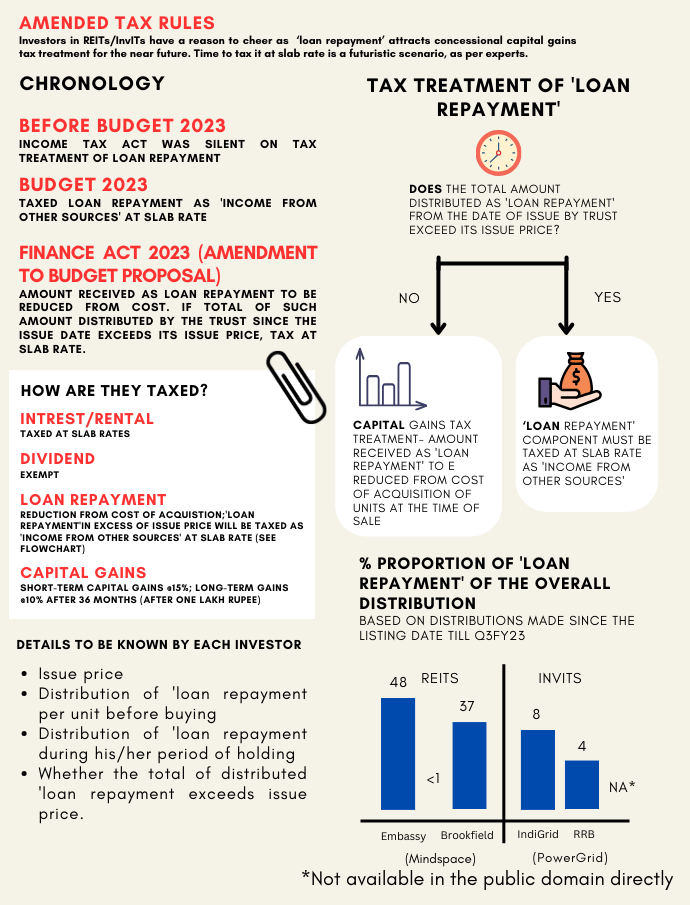

Because investors earn different types of income from REITs, two different tax rules apply: one for dividend income and one for capital gains. In addition, the tax treatment of investment redemptions through funds of international REITs also differs. The applicable tax regulations are as follows:

Taxation of Dividends: Under current regulations, REIT dividends are fully taxable in the hands of investors. Dividend distributions from REITs are included in the investor’s annual income and are taxed at the flat rate for the investor’s relevant fiscal year.

Taxation of Capital Gains: Capital gains on the sale of REIT stock are included in the short-term capital gains (STCG) and long-term capital gains (LTCG) applicable to equity investments. STCG applies when the holding period of the shares is 1 year or less from the date of allotment. The STCG imposes a 15% tax rate on capital gains from the sale of shares. If the holding period exceeds one year from the date of share allotment, the LTCG tax rules apply. For profits above Rs 1 lakh (all equity investments in the relevant financial year), LTCG is taxed at 10% without indexation gains.

Taxation of Capital Gains from Funds in International REITs: When a capital gain is realized through the sale of shares in a fund in an international REIT, non-equity capital gains tax rules apply. In this case, short-term capital gains apply if the holding period is 3 years or less (calculated from the allotment date). In this case, STCG corresponds to the flat rate applicable to the investor for that financial year. The LTCG tax applies to shares held for more than three years from the date of share allotment at a rate of 20% on index capital gains. Next, let’s look at how to invest in REITs.

Taxation on REIT

| Nature of Income | Tax Liability for Unit Holders |

| Dividend Income* | Exempt in the hands of unitholders |

| Rental Income | As per marginal tax slabs |

| Other Income (If any) | As per marginal tax slabs |

| Capital Repayment (till the cost at which unit was issued) | Treated as return of capital,i.e reduction from cost of acquisition |

| Sale of Units (Long Term Capital Gains – Holding Period > 3 Years) | Gains up to ₹1 lakh are exempted. Above ₹1 lakh, taxable at 10% |

| Sale of Units (Short Term Capital Gains – Holding Period < 3 Years) | Gains taxed at 15% |

* If REIT pays tax under section 115BAA, dividend will be taxable as per the tax slabs. TDS @ 10% will be applicable.

If you have any questions or wish to know more about “Real Estate Investment”, kindly Contact us.