Taxability of Intraday Trading

Derivative trading (stock, index options and futures and multi commodities) has gained a nice interest with all kind of investors. Many times traders gain and many times they lose the money in the stock market. Sometimes people who are salaried or have incomes like interest or other heads, have lesser idea on how to report and tax the gains or losses on intra-day transactions.

Our article intends to bring about a clarity on how to report and tax the intra-day gains and losses.

- Reporting under which head of income is applicable?

There are five major heads of income under the income tax provisions, which are salary, income from House property, Profits and Gains from Business and Professions (called as PGBP also), income under the head capital gains and incomes under other sources like interest, dividends etc.

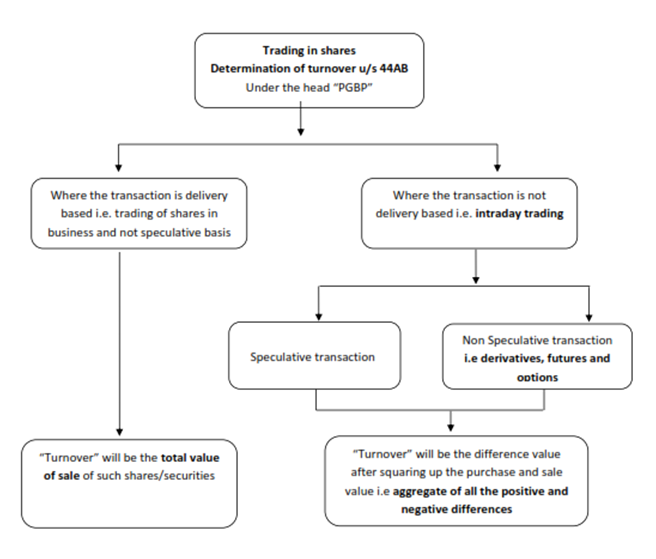

People often get confused about taxation of income from shares, intraday trading etc. whether taxable under head Capital Gains or PGBP.

Intra-day trading is required to be reported under the head Profits and Gains from Business and Profession. F&O Trading is considered as non-speculative business; however intra-day stock trading is considered as speculative business. Expenses like Brokerage, and STT can be claimed while calculating the profits. The return has to be filed in Form ITR-3. - What rate of tax is applicable?

If you are an individual assesse, then the applicable tax slab rate would be applicable to the business income, and if the assessee is a company, then depending upon turnover 22%,25% or 30% with applicable surcharge & cess. - Setting off the losses – whether allowed and how?

Similar to profits, losses from F&O trading are considered as non-speculative and can be adjusted from other heads of the income in the current year (except from head salary) and carried forward for 8 years and for future the same shall be set off from the head PGBP. For loss on intraday stocks, the same shall be a speculative loss, and can be adjusted from income in the same head for current year as well as future. As per section 73 of the Income Tax Act, Speculative loss can be carried forward upto 4 years and set off from speculative income. Reporting and treatment of speculative and non-speculative business income and losses are different, Rate of tax on speculative and non-speculative business incomes is same though.

We are citing a couple of examples to elaborate this:

Example 1:

| Source of Income | Amount Rs. |

| Income from House Property | 100,000 |

| Income from other sources | 50,000 |

| Income from head salary | 5,00,000 |

| Loss from intraday F&O trading | (3,00,000) |

In above case, the loss that can be set off is 150,000 as available from the head House Property and other sources, rest 150,000 can be carried forward and off set from income from head PGBP upto next 8 years.

Example 2:

| Source of Income | Amount Rs. |

| Income from House Property | 100,000 |

| Income from other sources | 50,000 |

| Income from head salary | 5,00,000 |

| Loss from intraday stock trading | (3,00,000) |

In this case since the loss is in the nature of speculative loss, hence it cannot be off set from any other head other than speculative income, but it can be carried forward for next 4 years and off set from speculative income.

- Whether maintenance of books of accounts is required under section 44AA?

For an individual or HUF having income taxable under head PGBP, it is mandatory to maintain books of accounts in case the income exceeds 2.5 Lakhs or gross receipts exceed 25 Lakh in any of the preceding 3 financial years. If assesse is not an individual or HUF, the limit of income is 1.2 lakhs and gross receipts 10 lakhs. Majorly one has to maintain P&L Account, Balance Sheet, Bank Book and cash book.These days, for the facilitation of small traders, trading statements and Profit & loss account etc. are also available at brokers app and one can simply download by putting in appropriate filters. Along with Profit & loss Account one can prepare basic balance sheet, bank books are usually handy and readily available these days.

- How about applicability of Audit?

Audit under section 44AB of the income tax is applicable based on Turnover of the business, if the Turnover of the business is more than Rs. 1 crore, and in case there are cash transaction limited to 5% of the turnover in case of receipts and 5% in case gross expenses, then Turnover more than Rs. 5 crores.

What constitutes the turnover of an intraday trader is defined separately. While calculating the turnover off an F& O trade, volume of sale and purchase both are included in the turnover in their absolute value. These days tax turnover can also be availed from brokers website or app by logging in and selecting the period.

Let us see an example for calculating turnover for Intraday as per Income Tax Provision:

Mr. X buys 1000 shares of ABC Ltd at Rs.100. He sells the shares at the end of the day at Rs.110. On the next day, he buys 200 shares of PQR Ltd at Rs.300 and at the end of that day, he sells the shares at Rs.280.

We are citing an another example for the calculation of the turnover:

| Type of transaction | Volume | Amount Rs. |

| Buying Call options | 75 qty x Rs. 100 | 7,500 |

| Selling call options | 75 qty x Rs. 150 | 11,250 |

| Buying put options | 75 qty x Rs. 50 | 3,750 |

| Selling put options | 75 qty x Rs. 30 | 2,250 |

| Turnover | 24,750 |

Therefore, it is important to note the turnover and comply with Audit provisions by getting the books of accounts audited by a Chartered Accountant. Due date for filing Income Tax Return for assessees having Tax Audit applicable is different from other assessees.

Due Date

- FY 2020-21 Onwards

31st July – for traders to whom Tax Audit is not applicable

31st October – for traders to whom Tax Audit is applicable