Corporate Compliances

Corporate compliance refers to the adherence and conformity of a company or organization to the laws, regulations, guidelines, and ethical standards that apply to its industry and operations. It involves implementing policies, procedures, and practices to ensure that the organization operates within the legal and ethical boundaries set by regulatory authorities

Corporate compliance is crucial for businesses to maintain transparency, integrity, and accountability. It helps prevent legal and ethical violations, protects the interests of stakeholders, and mitigates the risk of fines, penalties, and reputational damage. Compliance requirements can vary depending on the industry, size, and geographic location of the company.

In India, many compliances are prescribed to various organisations by various laws, not just according to location or business type but there are variety of compliances applicable on various factors like turnover, no. of employees, business activity etc.

Major compliances are:

-

Ministry of Corporate Affairs – periodical filings

- Ministry of Corporate Affairs - Annual filings

- Income Tax Filings and other compliances

- TDS deduction, deposition, reporting and certification

- GST – filings and compliances

- Labour laws, labour welfare and social security coverage

- Production and manufacturing – licensing and renewals

- Export and import related

- Foreign Exchange Management Act realted and RBI compliances regarding remittances

RAAAS can help you in meeting all these compliances in a manner that there should be no penalties or liabilities arising against the organization.

Corporate compliance is essential due to various factors affecting businesses and organizations: -

- Legal and Regulatory Compliance: Corporate compliance is crucial for businesses to avoid legal consequences and operate within legal boundaries, minimizing risks and ensuring compliance with laws and regulations.

- Ethical Standards and Reputation: Ethical standards are crucial for maintaining a positive reputation and trust among stakeholders, as unethical behavior can damage a company's image.

- Risk Management: Compliance activities identify, assess, and manage risks related to legal and regulatory non-compliance, minimizing financial, legal, operational, and reputational risks through robust programs.

- Stakeholder Protection: Compliance protects stakeholders, ensuring fair business practices, confidentiality, workplace safety, and preventing discrimination, fostering trust and security for sustainable business growth.

- Global Expansion and Market Access: Global expansion requires compliance with international laws and regulations, including data privacy, anti-corruption, trade, and export controls, to access new markets and avoid legal and reputational risks.

- Investor Confidence and Financial Integrity: Compliance is crucial for investor confidence and financial integrity, as it enhances corporate governance, transparency, and reduces fraud risk.

- Avoidance of Penalties and Legal Consequences: Non-compliance with laws and regulations can lead to financial penalties, legal disputes, and criminal charges. Implementing effective compliance programs helps organizations avoid these consequences and maintain financial well-being.

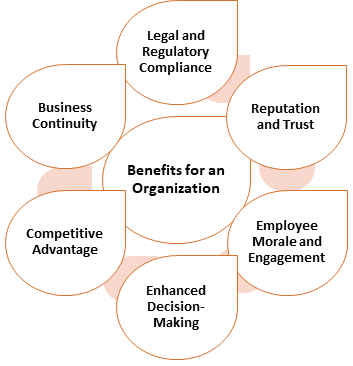

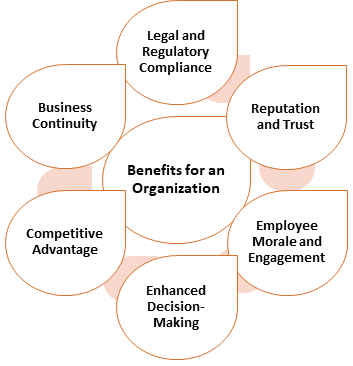

How can corporate compliances benefit an Organization?

Corporate compliance offers numerous benefits for organizations such as: -

- Legal and Regulatory Compliance: Organizations can avoid penalties, fines, lawsuits, and maintain positive relationships with regulatory authorities by ensuring legal and regulatory compliance.

- Reputation and Trust: Compliance enhances an organization's reputation, builds trust, and increases customer loyalty, brand perception, and competitiveness through ethical conduct, transparency, and responsible business practices.

- Employee Morale and Engagement: Clear compliance policies and ethical guidelines foster a positive work environment, increasing employee morale, productivity, and loyalty. Encouraging reporting and reporting of concerns promotes open communication.

- Enhanced Decision-Making: Clear compliance policies and ethical guidelines foster a positive work environment, increasing employee morale, productivity, and loyalty. Encouraging reporting and reporting of concerns promotes open communication.

- Competitive Advantage: Organizations with strong compliance commitment gain a competitive advantage in industries, attracting clients and customers who prioritize ethical businesses.

- Business Continuity: Compliance programs ensure business continuity by identifying and addressing gaps, minimizing regulatory risks, legal disputes, and reputational crises.

Penalties that can result from Non Compliances

Non-compliance with corporate compliance penalties varies by laws, regulations, and jurisdictions. Legal professionals or regulatory authorities should provide specific information for specific penalties. Here are some examples of penalties that can result from non-compliance:

- Fines and Monetary Penalties: Non-compliance with regulations can lead to fines or monetary penalties, varying based on severity, organization size, and jurisdiction.

- Legal Proceedings and Lawsuits: Non-compliance can lead to legal actions, resulting in financial settlements damages, or court-ordered remedies.

- License Revocation or Suspension: Non-compliance can result in license revocation or suspension, halting business operations until compliance is achieved.

- Reputational Damage: Non-compliance can damage a company's reputation, brand image, and attract customers, partners, and investors.

- Criminal Charges: Criminal charges may arise for non-compliance, including fraud, corruption, and involve fines, imprisonment, or both.

- Regulatory Enforcement Actions: Regulatory authorities can enforce actions against non-compliant organizations, including administrative penalties, cease and desist orders, and sanctions.

There are various compliances applicable on companies and LLP which are regulated by the Companies Act 2013. We at RAAAS, help you in meeting all the compliances, which actually are increasing on daily basis, like a cake walk. Few of these are:

Routine changes in the company details:

- Change in Name

- Change in main objects

- Change in Registered Office within the state

- Change in Registered Office outside the state

- Change in Directors like resignation, appointment, regularization of additional Directors

- Removal of Directors

- Change in share capital

- Annual filing of the company

- Annual Filing of LLP

- Compliances related to Mergers and acquisition

- ESOP, ESAR compliances

- Section 8 company compliances

- NBFC Compliances