E-COMMERCE POLICY -CHANGES AND EFFECTS

What is e – commerce ?

E-commerce means buying and selling of goods and services including digital products over digital & electronic network.

What is E- Commerce Policy?

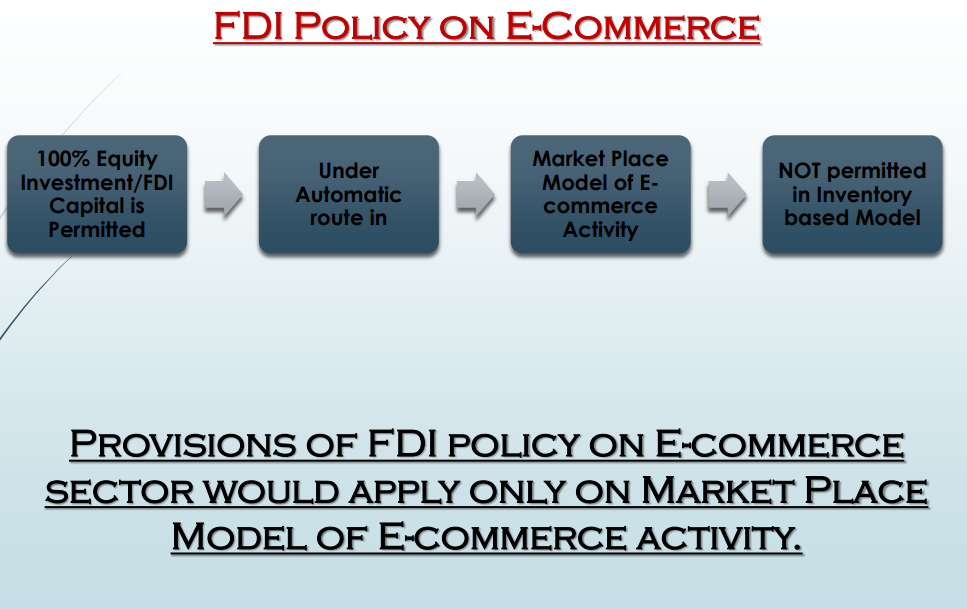

Policy of Foreign Direct Investment (FDI) in E-commerce sector as provided by Department of Industrial Policy and Promotion, Ministry of Commerce and Industry, Government of India in Para 5.2.15.2 of Consolidated Policy Circular 2017.(https://dipp.gov.in/sites/default/files/CFPC_2017_FINAL_RELEASE D_28.8.17.pdf)

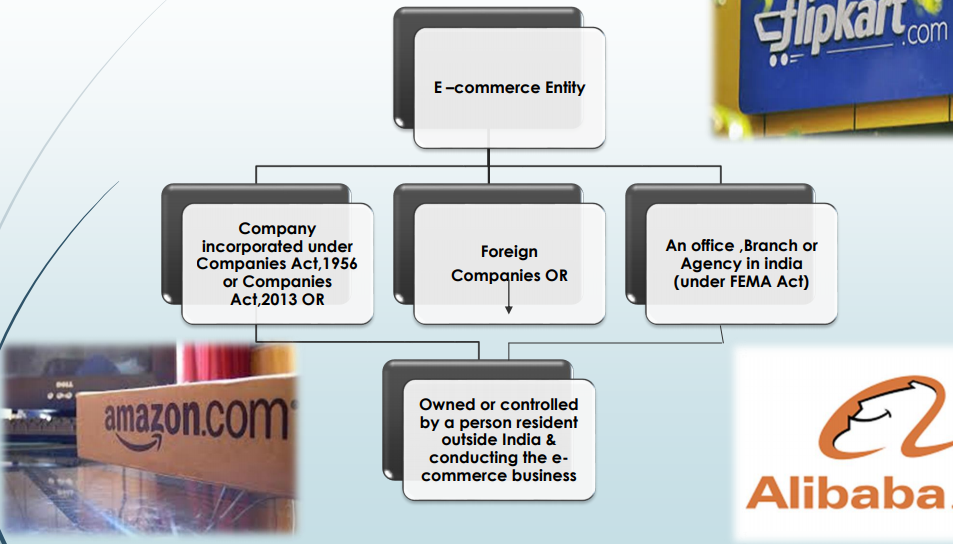

What is e – commerce entity?

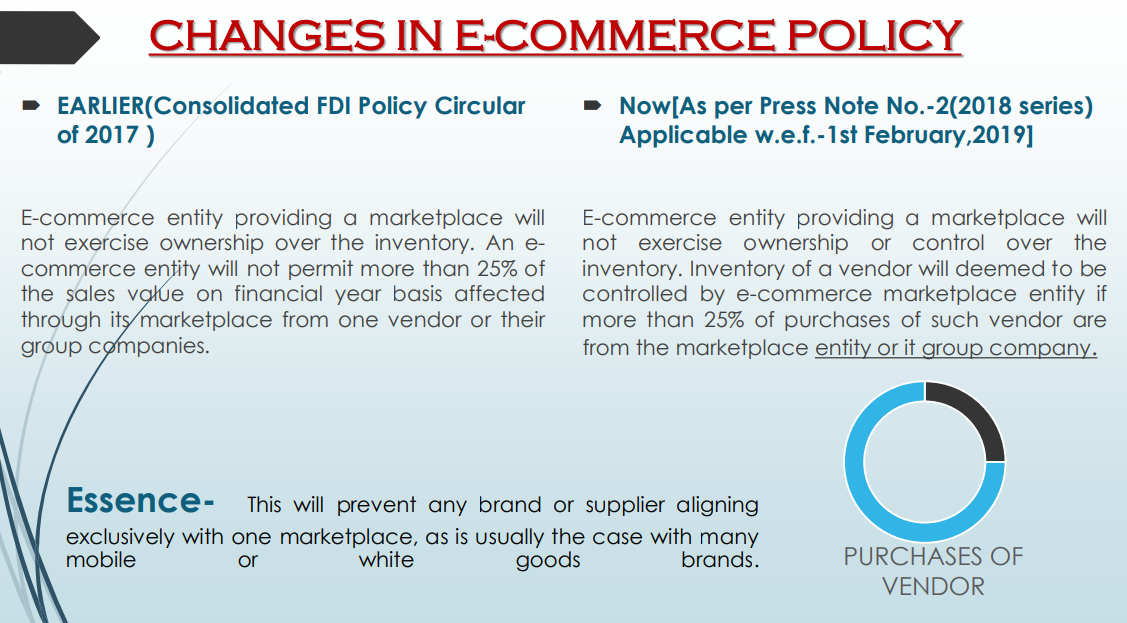

EARLIER(Consolidated FDI Policy Circular of 2017 )

Cashback and discriminating prices:- No such Clause

Now [As per Press Note No.- 2(2018 series) Applicable w.e.f.-1st February,2019]

Provision of services to any vendor or such terms which are not made available to other vendors in similar circumstances will be deemed unfair and discriminatory. Cashback provided by group Companies of market place entity to buyer shall be fair and nondiscriminatory.

Essence

Low cashback and approximately equal prices for products. The policy prohibits ecommerce platforms from giving any preferential treatment to any supplier.

Effects of changes in Policy

Adverse Effects

1. Deep discounts disappears: Big online sales may disappear and one of the main method of attracting customers i.e. deep discounts on Flipkart or Amazon may not be usable now.

2. Buyers inconvenience :- Customers will now have to check other shopping websites and even may have to Switch to real shops. Now buyers may have to visit the traditional street side shop to get better prices and discounts.

3. End of Cashbacks:-the buyers whose buying decisions get affected on the basis of cashback available would have great impact as the guidelines imply the end of cashbacks.

4. End of exclusive deals:- New policy clearly prohibits E –commerce entity to force any vendor to sell products only on its platform. This clearly means end of ‘exclusive/prime deals’ which are generally run by Flipkart and Amazon India.

5. Lack of choice:-The new policy prohibits entities from selling its products on e-commerce platform, in which the e-commerce platform has an equity investment.This implies choice would be reduced due to this provision.

Gainers from New E-commerce policy:-

Retail stores: New guidelines restricts discounts and cashbacks will help Retail stores i.e.brick-andmortar retailer retain customers.

Small ecommerce companies:-To compete with giants like Amazon/Flipkart, smaller ecommerce companies don’t have enough money .These Small e –commerce Companies will stand to gain from the new norms .

Small sellers:-an ecommerce platform which provide any service– logistics, warehousing or easy financing options – will now have to offer to all sellers and no preference would be given to any particular seller.

If you have any Query? Click here