Guide to Filing GSTR-11 in 2024: Tips, Updates, and Common Mistakes to Avoid

Introduction

The Goods and Services Tax (GST) regime in India has introduced various forms and procedures for different categories of taxpayers. Among these forms, GSTR-11 is designed for a distinct group of taxpayers—those who hold a Unique Identity Number (UIN). This guide will provide you with everything you need to know about GSTR-11, including its format, eligibility criteria, rules, and a step-by-step process for filing it.

What is GSTR-11?

GSTR-11 is a return form under India’s Goods and Services Tax (GST) regime, specifically designed for individuals or organizations issued a Unique Identity Number (UIN), such as foreign diplomatic missions and embassies. These UIN holders, though exempt from paying taxes in India, may still incur GST on certain purchases made within the country. GSTR-11 allows them to file a quarterly statement of inward supplies, enabling them to claim refunds on the GST paid. This form ensures that UIN holders can reclaim any GST charges while maintaining their tax-exempt status as recognized by international agreements and Indian laws.

Eligibility for GSTR-11

UIN holders are a special category under the GST regime. The UIN is issued to particular organizations or people who are absolved from paying charges in India. The primary entities eligible to hold a UIN and, consequently, required to file GSTR-11 include:

- Specialized agencies of the United Nations Organization: These are international bodies that enjoy privileges and immunities under international law.

- Multilateral financial institutions and organizations: These institutions are notified under the United Nations (Privileges and Immunities) Act, 1947, and operate in India with tax-exempt status.

- Consulates or Embassies of foreign countries: These entities represent their respective governments in India and are typically exempt from local taxes under international agreements.

- Other persons or classes of persons: As notified by the GST Commissioner, these may include various other entities granted similar privileges.

To get a UIN, these organizations must apply utilizing Frame GST REG-13.

Purpose of GSTR-11

The primary purpose of GSTR-11 is to enable UIN holders to claim refunds for the GST paid on their inward supplies. These inward supplies could include goods and services purchased for official purposes within India. The filing of GSTR-11 is not a regular, monthly process but is done only when such entities make purchases on which GST is levied.

Due Date for Filing GSTR-11

The GSTR-11 form must be submitted by the 28th of the month following the month in which the inward supplies were received.For example, if the Canadian Embassy paid GST of Rs 55,000 on food, hotel, etc., during their stay in India for the month of June 2023, they must file the return in GSTR-11 by the 28th of July 2023 to claim a refund of the taxes paid.

Important Details for GSTR-11 Filing

- Due Date: August 28, 2024

- Form: GSTR-11

- Period: July 2024

- Description: Statement of Inward Supplies by persons having a Unique Identification Number (UIN) for claiming a GST refund.

Details Required in GSTR-11

GSTR-11 is a relatively straightforward form with four main sections:

- Unique Identity Number (UIN): This is the unique identification number assigned to the organization by the GST administration.

- Name of the UIN holder: This field is auto-populated and displays the name of the organization or individual holding the UIN.

- Details of Inward Supplies Received: This section requires the GSTIN (Goods and Services Tax Identification Number) of the suppliers. The details of the inward supplies are automatically populated from the GSTR-1 returns filed by the suppliers.

- Refund Amount: The refund amount is auto-calculated based on the details provided in the previous sections.The UIN holder must give their bank accountSignificant details to get the discount.

After filling in these details, the UIN holder must authenticate the return using a Digital Signature Certificate (DSC) or Aadhaar-based signature verification.

Recent Updates Related to GSTR-11

The GST Council and the Central Board of Indirect Taxes and Customs (CBIC) periodically update the rules and procedures associated with GST returns, including GSTR-11. As of December 22, 2020, several amendments were made to ensure greater compliance and transparency:

- Rule 21 Amended: The GSTIN can be canceled if there are discrepancies between the outward supplies reported in GSTR-1 and GSTR-3B.

- Rule 21A(2A) Inserted: Significant differences in outward or inward supplies between GSTR-3B, GSTR-1, and GSTR-2B can lead to suspension of GSTIN.

- Rule 59(5) Inserted: If GSTR-3B is not filed for the preceding two months (for monthly filers) or the preceding tax period (for quarterly filers), the GSTR-1 for the current period cannot be filed.

- Rule 138E Amended: E-way bills cannot be generated if the GST registration is suspended due to significant discrepancies in returns.

These amendments are crucial for UIN holders to be aware of, as they impact the filing process and the eligibility for claiming refunds.

GSTR-11 Format Overview

GSTR-11 is designed to be straightforward and less complex compared to other GST forms. It consists of four main sections:

1. UIN

- Description: Enter the Unique Identification Number (UIN) assigned to the individual or organization.

- Auto-Population: After entering the UIN, the name of the person or organization holding the UIN will automatically populate.

2. Name of Person/Organization Holding UIN

- Description: Once the UIN is entered, this field will automatically display the name associated with the UIN. It cannot be manually edited or added.

3. Information About Inward Supplies Acquired

- Description: Enter the GSTINs of the suppliers from whom inward supplies were acquired.

- Auto-Population: Supplier details from their filed GSTR-1 returns will automatically appear based on the GSTINs provided. The UIN holder cannot edit or add these automatically filled details.

4. Refund Amount Due

- Description: This section calculates the refund amount due from the previous month’s GST payments automatically.

- Bank Account Information: Provide your bank account details here to facilitate the crediting of the refund.

5. Authorization & Signature

- Description: After completing all the required information, the UIN holder must digitally sign the GSTR-11 form.

- Signing Options: The form can be signed using either an Aadhaar-based signature verification or a Digital Signature Certificate (DSC).

- Submission Confirmation: By providing the digital signature, the UIN holder confirms the submission of the return.

This format ensures that GSTR-11 filing is simplified, with automatic data population to minimize manual entry and reduce errors.

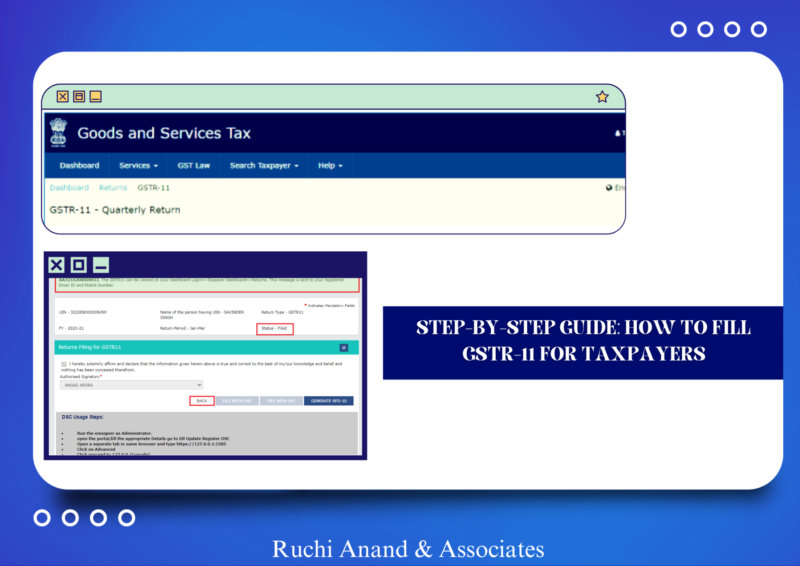

Step-by-Step Guide to Filing GSTR-11 on the GST Portal

A. Login and guide to Form GSTR-11 Page

- Access GST Portal:

- Visit gst.gov.in. Log in using your GST credentials.

- Navigate to Returns Dashboard:

- Click on the menu: Services > Returns > Returns Dashboard. Alternatively, you can access the Returns Dashboard directly from the homepage.

- Select Financial Year & Period:

- On the File Returns page, choose the Financial Year and the Return Filing Period from the drop-down menus. Click SEARCH to proceed.

- Prepare Form GSTR-11:

- Locate the GSTR-11 tile and click the PREPARE ONLINE button to start preparing your return online.

B. Download and See Auto-Drafted information for Form GSTR-11 (Excel)

- Download Auto-Drafted Details:

- Click on DOWNLOAD AUTO DRAFTED DETAILS FOR GSTR-11 (EXCEL) to download the pre-filled details based on the Form GSTR-1/5 filed by your suppliers.

- Handling Large Records:

- For records exceeding 500, the download might take up to 20 minutes. Multiple download links will appear for large datasets.

- Review Auto-Drafted Excel:

- Open the downloaded Excel file. The details will be organized in various worksheets:

- 3A-B2B: Taxable inward supplies from registered persons.

- 3A-B2BA: Amendments to previously filed invoices.

- 3B-CDNR: Credit or Debit notes details.

- 3B-CDNRA: Amendments to previously filed credit/debit notes.

- Open the downloaded Excel file. The details will be organized in various worksheets:

C. Initiate Pre-Fill of Form GSTR-11

- Initiate Pre-Fill:

- Click on INITIATE PRE-FILL OF GSTR-11 to auto-populate Form GSTR-11 with details from your suppliers’ Form GSTR-1/5.

- Confirmation of Request:

- A confirmation message will appear. The pre-filling process may take up to 20 minutes.

- Review Auto-Populated Data:

- After completion, review, edit, or delete the auto-populated records in Form GSTR-11.

- Check Status in Downloaded Excel:

- Re-download the auto-drafted details to verify the upload status and address any discrepancies.

D. Enter/View/Edit/Delete Details in Various Tiles

- Details of Invoices Received (Table 3A):

- Click on 3A – Details of Invoices received tile.

- Click ADD DETAILS to enter new invoice details.

- Enter GSTIN, invoice number, date, and value. Specify whether transactions are intra-state or inter-state.

- Details of Credit/Debit Notes Received (Table 3B):

-

- Click on 3B – information of Credit/Debit Notes received tile.

- Click ADD DETAILS to add credit/debit note details.

- Provide GSTIN, note number, date, and value. Indicate intra-state or inter-state transactions.

E. Preview Form GSTR-11

- Preview Draft Form:

- Click PREVIEW DRAFT GSTR-11 (PDF) to download and review a draft summary of Form GSTR-11.

- Review Draft Summary:

- Ensure that all details are accurate before proceeding to the next step.

F. File Form GSTR-11 with DSC/EVC

- File Return:

- Click the FILE RETURN button and check the Declaration checkbox.

- Choose Filing Method:

- Select between FILE WITH DSC or FILE WITH EVC:

- FILE WITH DSC:

- Tap Proceed, select your certificate, and press SIGN.

- FILE WITH EVC:

- Enter the OTP received on the authorized signatory’s email and mobile number, then click VERIFY.

- Completion and ARN Generation:

- A success message will appear, and an ARN (Acknowledgement Reference Number) will be generated. The status will change to “Filed.”

- Generate RFD-10:

- After filing, tap Create RFD-10 to make Form GST RFD-10 for claiming a refund.

Avoid These Common Mistakes When Filing GSTR-11 for Accurate and Smooth Submission

When filing GSTR-11, it’s crucial to avoid common mistakes to ensure accuracy and compliance. Common errors include entering incorrect invoice details, mismatched GSTINs, and miscalculations of tax amounts. To prevent these issues, thoroughly review all entries and verify that information aligns with your records and those of your suppliers.Careful checking witness guarantee a smooth filing process and exact accommodation.

Penalties for Late Filing of GSTR-11

Penalties for late filing of GSTR-11 can be substantial. If the form is not submitted by the due date, the taxpayer may incur an interest charge at an annual rate of 11% on the outstanding tax amount. Additionally, a late fee of Rs. 200 per day is applicable, split equally between SGST and CGST, with each component being Rs. 100 per day.

Conclusion

GSTR-11 is an essential return form for UIN holders under the GST regime in India. It allows them to claim refunds for the GST paid on inward supplies, ensuring that these tax-exempt entities are not burdened by the indirect tax. By following the step-by-step guide provided in this article, UIN holders can efficiently file their GSTR-11 returns and comply with the GST regulations. Staying updated with the latest amendments and rules is also crucial for ensuring smooth compliance and avoiding any legal hassles.

FAQs

- Is it necessary to auto-populate GSTR-11?

Answer:Yes, auto-populating GSTR-11 is a crucial step as it ensures that the details of inward supplies from registered suppliers are accurately captured based on their GSTR-1 filings. This process minimizes manual entry errors and ensures that all eligible transactions are included in the return for claiming refunds. Auto-population also simplifies the filing process by pre-filling the relevant sections, saving time and reducing the risk of discrepancies.

- What happens after filing GSTR-11?

Answer:After filing GSTR-11, the following steps occur:

-

- Acknowledgment Generation: Once you successfully file the return, an Acknowledgement Reference Number (ARN) is generated, confirming the submission.

- Refund Processing: The refund amount claimed based on the inward supplies listed in GSTR-11 will be processed by the tax authorities. If everything is in order, the refund will be credited to the bank account details provided in the form.

- Status Update: The status of your GSTR-11 will be updated to “Filed” on the GST portal, and you can track the progress of your refund claim through the portal.

- What are the consequences of not filing GSTR-11 on time?

Answer:Failure to file GSTR-11 by the due date can lead to the following consequences:

-

- Delay in Refunds: Your refund claim for the GST paid on inward supplies will be delayed until the form is filed.

- Compliance Issues: Non-filing may lead to compliance notices from the GST authorities, potentially resulting in penalties or legal action, depending on the severity of the delay.

- Impact on Supplier Records: Your suppliers’ records may reflect discrepancies if your GSTR-11 is not filed, which could lead to issues in their GST filings as well.

- Can GSTR-11 be revised after filing?

Answer:No, once GSTR-11 is filed, it cannot be revised. Therefore, it is crucial to review all the details thoroughly before submitting the form. If any mistakes are found after submission, you may need to contact the GST authorities to rectify the issue, but this process may not always result in corrections to the filed return.

- Who is required to file GSTR-11?

Answer:GSTR-11 is specifically required for individuals or organizations holding a Unique Identity Number (UIN), such as foreign diplomatic missions, embassies, and other international bodies that are exempt from paying GST in India. These entities file GSTR-11 to claim refunds on the GST paid on their inward supplies within India.