Hello foreign parent company – what tax you will pay on receiving dividend from your Indian Subsidiary

Meaning of Foreign Subsidiary Company

A foreign subsidiary company is any company, where 50% or more of its equity shares are owned by a company that is incorporated in another foreign nation. For example, a company incorporated in USA (Parent company) is executing the same business operation through an Indian subsidiary company. However, this company should abide by the rules and regulations of the domestic law of the corresponding country where it is situated, it should not follow the laws applicable to its parent company.

As per section 2, clause 22, “dividend” includes–

- Distribution of accumulated profits to shareholders entailing release of the company’s assets;

- Distribution of debentures or deposit certificates to shareholders out of the accumulated profits of the company and issue of bonus shares to preference shareholders out of accumulated profits;

- Distribution made to shareholders of the company on its liquidation out of accumulated profits;

- Distribution to shareholders out of accumulated profits on the reduction of capital by the company; and

- Loan or advance made by a closely held company to its shareholder out of accumulated profits.

Taxability of Dividends before AY 2020-2021:

If a shareholder gets dividend from a domestic company on or before the 31st day of March, 2020, then he/she shall be exempt from tax under section 10(34) of the Act and the domestic company is liable to pay a Dividend Distribution Tax (DDT) @15% (excluding surcharge and cess) under section 115-O of the Income Tax Act. In case of dividend under Section 2 (22) (e), the DDT rate shall be substituted from 15% to 30%.

Taxability of Dividends paid by Indian company to Foreign Parent Company

Tax Withheld u/s 195 on the Dividend paid to Foreign Parent Company: In accordance with the provisions of Section 195 of the Income Tax Act, tax is required to be withheld @ 20% (plus applicable surcharge and cess) on the amount of dividend payable to foreign parent company. The TDS withheld by the payer must be deposited to the Government within 7th of the next month (except in case of Tax Deductible in March, the due date is 30th April of the next year.

Section 90- Avoidance of Double Taxation Avoidance Agreement

As per section 90 of the Income Tax Act, a non-resident shareholder has an option to be governed by the provisions of the Double Taxation Avoidance Agreement (‘DTAA’) between India and the country of tax residence of the shareholder, if such provisions are more beneficial to such shareholder to avoid of double taxation of income under this Act and under the corresponding law in force in that country. Here are the few examples:

- Tax treaty between India and Germany determines that their bilateral withholding tax on dividends is 10%, then India will tax dividend payment that are going to Germany at a rate of 10%, and vice versa.

- In case of tax treaty between India and Canada, the withholding tax on dividend is 15% if at least 10% of the shares of the company paying the dividends is held by the recipient of dividend. But in other cases, the withholding tax on dividend is 25%, hence the India will tax divided payment at the rate of 20%.

- In case of tax treaty between India and United Kingdom, the withholding tax on dividend is 10%. But in case the dividends are paid out of income (including gains) derived directly or indirectly from immovable property within the meaning of Article 6 by an investment vehicle, the withholding tax on dividend is 15% of the gross amount of the dividends.

Documents required by the non-resident shareholder to avail the DTAA benefits:

- Self-attested copy of PAN, if any, allotted by the Indian tax authorities. In case of non-availability of PAN, declaration is to be submitted.

- Self-attested copy of valid Tax Residency Certificate (‘TRC’) issued by the tax authorities of the country of which shareholder is tax resident, evidencing and certifying shareholder’s tax residency status.

- Completed and duly signed self-declaration in Form 10F.

- Self-declaration certifying the following points that the shareholder: –

- is and will continue to remain a tax resident of the country of its residence during the FY

- is the beneficial owner of the shares and is entitled to the dividend receivable from the Company.|

- qualifies as ‘person’ as per DTAA and is eligible to claim benefits as per DTAA for the purposes of tax withholding on dividend declared by the Company.

- has no permanent establishment / business connection / place of effective management in India OR Dividend income is not attributable/effectively connected to any Permanent Establishment (PE) or Fixed Base in India.

- has no reason to believe that its claim for the benefits of the DTAA is impaired in any manner

Relief under Section 91- Countries with which no agreement exists

When there is no agreement under section 90 for the relief or avoidance of double taxation, section 91

the Income Tax Act provides relief from double taxation in such cases.

If any person who is resident in India in any previous year proves that, in respect of his income is not deemed to accrue or arise in India and with which there is no agreement under section 90, he shall be entitled to the deduction from the Indian income-tax payable by as under:

A sum calculated on such doubly taxed income at the Indian rate of tax or

the rate of tax of the said country, whichever is the lower or

At the Indian rate of tax if both the rates are equal.

Rule 128- Foreign Tax Credit

The foreign tax means—

- in respect of a country or specified territory outside India with which India has entered into an agreement for the relief or avoidance of double taxation of income in terms of section 90;

- in respect of any other country or specified territory outside India, the tax payable under the law in force in that country or specified territory in the nature of income-tax referred to section 91.

An assessee, being a resident shall be allowed a credit for the amount of any foreign tax paid by him in a country or specified territory outside India, by way of deduction or otherwise, in the year in which the income corresponding to such tax has been offered to tax or assessed to tax in India.

Note: Where income on which foreign tax has been paid or deducted, is offered to tax in more than one year, credit of foreign tax shall be allowed across those years in the same proportion in which the income is offered to tax or assessed to tax in India.

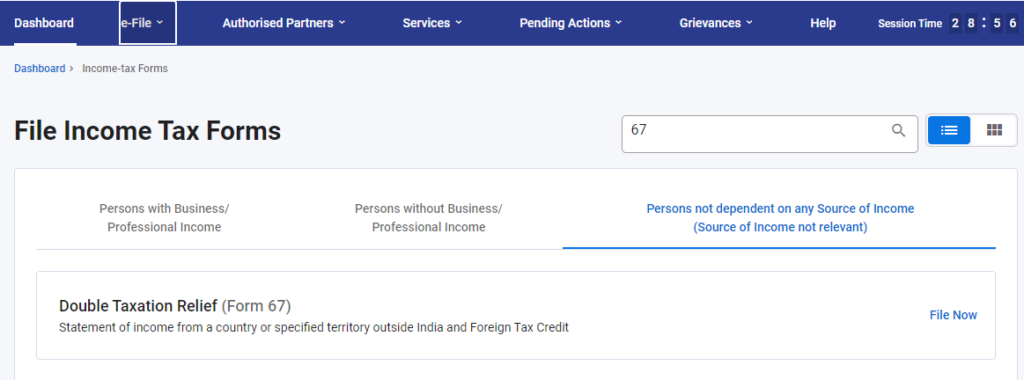

An assessee is required to submit Form 67 if you want to claim credit of foreign tax paid in a country or specified territory outside India.

Form 67- Double Taxation Relief

Form 67 can be submitted online only on the e-Filing portal. It should be filed before the due date of filing of return as specified u/s 139(1).

The form has 4 sections:

- Part A of the form contains basic information such as your Name, PAN or Aadhaar, Address and the Assessment Year. You are required to the add the receipt details of the income from a country or specified territory outside India and Foreign Tax Credit claimed.

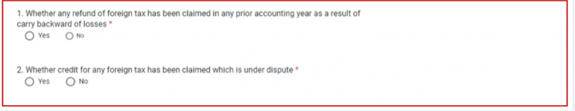

- In Part B, you are required to provide details of refund of foreign tax as result of carry backward of losses and disputed foreign tax.

- The Verification section contains a self-declaration form following fields:

4. Attachments section is where you need to attach a copy of the certificate or statement and proof of payment / deduction of foreign tax.

Section 197- Lower Deduction Certificate

Section 197 of the Income Tax Act, 1961 provides for the facility of Nil deduction of tax at source or at a deduction at a Lower rate of tax. As per Rule 28 of the Income Tax Act, an application by a person for grant of a certificate for the deduction of income-tax at any lower rates or no deduction of income-tax under section 197(1) shall be made through Form No. 13 electronically under digital signature or through electronic verification code. The step-by-step procedure is as follows:

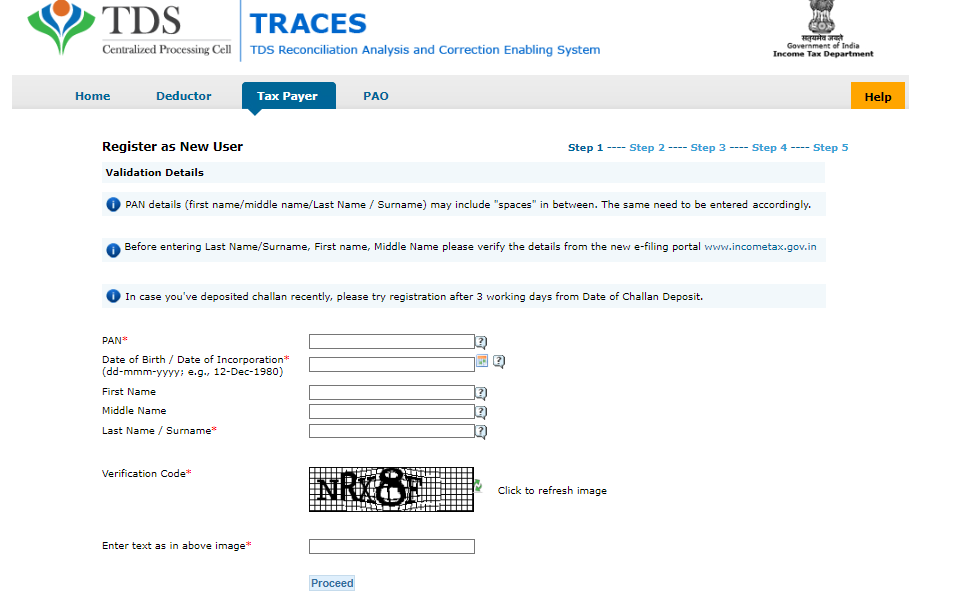

Step 1: Visit the Traces Portal: https://www.tdscpc.gov.in/app/login.xhtml and register as a new user- taxpayer.

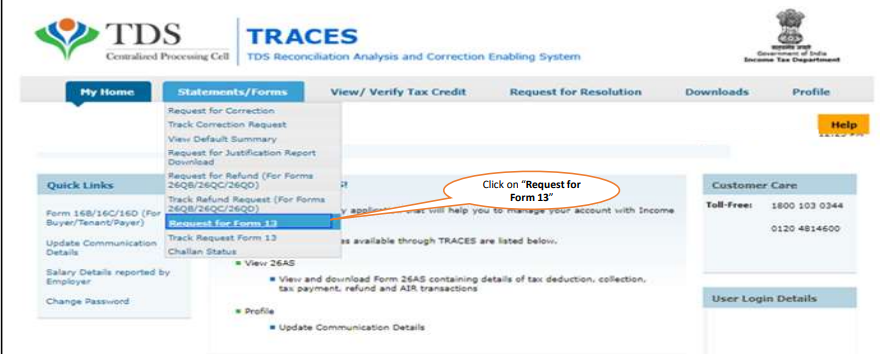

Step 2: Go to ‘Statements/Forms’ tab and click on ‘Request for Form 13’ to initiate request. A Pop-Up shall be displayed (If the DSC is not registered). Click on ‘Yes’ to proceed further.

Step 3: Select the residential status as ‘Non Resident’.

Step 4: Check list for 197/206C will appear on the next screen. Click on ‘Proceed’ button. User can also download the checklist after clicking on “Download” button. Downloaded file will be available in PDF format.

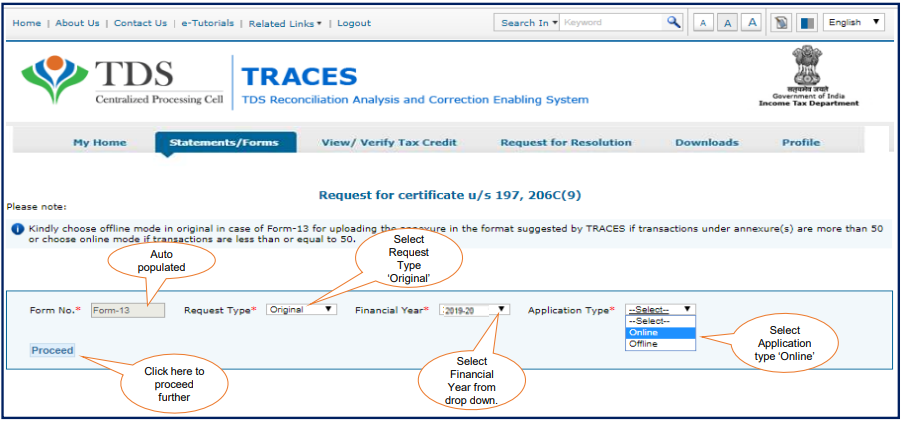

Step 5: Form No. (Form- 13) will be auto populated, Select Request Type, Financial Year and Application Type from drop down then click on ‘Proceed’ button.

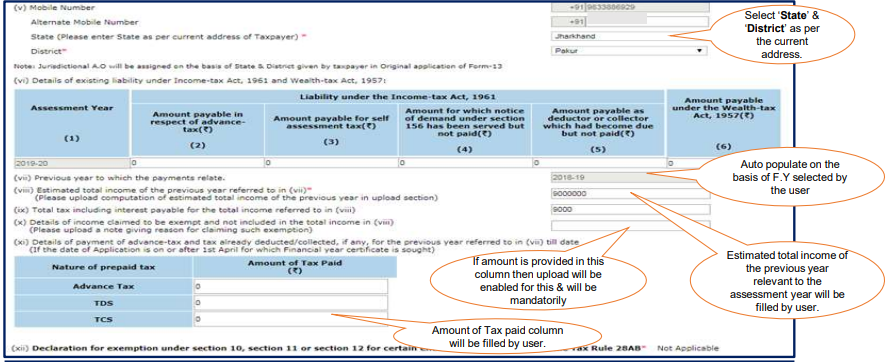

Step 6: User need to fill details which needs to be furnished in Form -13, some of the details are auto-populated on the basis of TRACES profile.

You may refer the e-tutorial by Traces Portal from the given link:

https://contents.tdscpc.gov.in/docs/E-tutorial-%20Request%20for%20Form%2013-%20Non%20Resident.pdf

Step 7: Select the type of annexure and click on ‘Proceed’ button. User needs to select ‘Annexure-I for No/Lower Deduction’ in case of TDS or ‘Annexure-III for Lower Collection’ in case of TCS.

After selecting Annexure-I (No/Lower Deduction). Click on ‘Add Row’ button to add the transaction details in Annexure-I, then enter details like TAN number, Section Code, Estimate amount of Income and the requested rate of deduction then click on Save & Proceed button.

Upload the files and fill the Estimated Income Computation of the Financial Year for which certificate is sought be. User need to provide the declaration to proceed further. Click on ‘Preview & Submit’ button to preview the submitted details for Form-13.