SABKA VISHWAS (LEGACY DISPUTE RESOLUTION) SCHEME, 2019 (open for 1-9-2019 to 31-12-2019)

- Scheme Highlight

- With a specific window period to exercise the option

- Proceedings under the scheme specifically stated to not be treated as a precedent for past and future liabilities

- Coverage: – 28 enactments including Excise & Service Tax

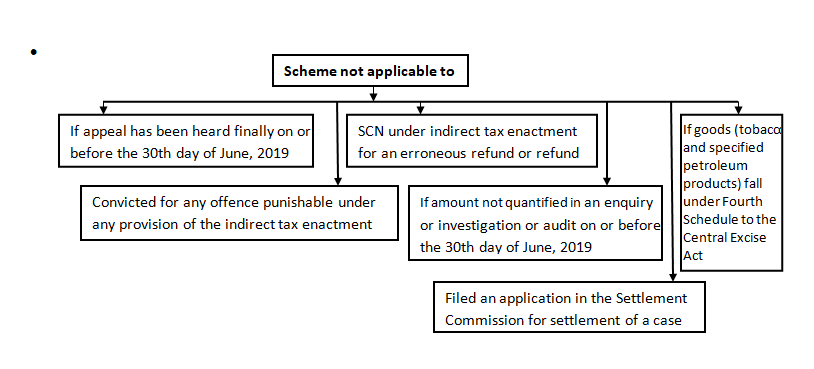

Note- the final hearing has not taken place as on 30.06.2019

*** ‘Quantified’ means a written communication of the amount of duty payable under the indirect tax enactment [Section 121(g)]. Such written communication will include a letter intimating duty demand; or duty liability admitted by the person during enquiry, investigation or audit; or audit report etc.

- A person making a voluntary disclosure:-

(i) After being subjected to any enquiry or investigation or audit; or

(ii) Having filed a return under the indirect tax enactment, wherein he has indicated an amount of duty as payable, but has not paid it; - This scheme is applicable on –

The Central Excise Act, 1944 or the Central Excise Tariff Act, 1985 or Chapter V of the Finance Act, 1994 and the rules made there under;The following Acts, namely:

The Agricultural Produce Cess Act,1940, The Coffee Act, 1942, The Mica Mines Labour Welfare Fund Act, 1946, The Rubber Act, 1947, The Salt Cess Act, 1953, The Medicinal and Toilet Preparations (Excise Duties) Act, 1955, The Additional Duties of Excise (Goods of Special Importance) Act, 1957, The Mineral Products (Additional Duties of Excise and Customs) Act, 1958, The Sugar (Special Excise Duty) Act, 1959, The Textiles Committee Act, 1963, The Produce Cess Act, 1966, The Limestone and Dolomite Mines Labour Welfare Fund Act, 1972, The Coal Mines (Conservation and Development) Act, 1974, The Oil Industry (Development) Act, 1974, The Tobacco Cess Act, 1975, The Iron Ore Mines, Manganese Ore Mines and Chrome Ore Mines Labour Welfare Cess Act, 1976, The Sugar Cess Act, 1982 & The Finance Act. - This scheme provides for a substantial relief margin on all Duty demands, ranging from 40% to 70% of the demand, except in the case of voluntary disclosure. The relief will be applicable as follows-

| Relief Available from the Duty Demand | For Cases Pending Adjudication or Appeal* | For Cases of Confirmed Duty Demands (Where No Appeal is Pending) | For Cases of Voluntary Disclosure |

| Duty demands up to Rs.50 lakh | 70% | 60% | The full amount of duty disclosed |

| Duty demands >Rs.50 lakh | 50% | 40% |

- The following consequences:

- In case adjudication order determining the duty/tax liability is passed and received prior to 30.06.2019, but the appeal is filed on or after 01.07.2019 than not eligible under the Litigation category. However, such a person may choose to withdraw the appeal, and furnish to the department an undertaking to not file any further appeal in the matter. In this case, he can make a declaration under the Arrears category.

- If any person convicted for an offence punishable under a provision of the indirect tax enactment. However, in respect of the same matter, I intend to file a declaration under the Scheme than such person will not be eligible.

- Restrictions of Scheme.

(i) Any amount paid under this Scheme:- - shall not be paid through the input tax credit account under the indirect tax enactment or any other Act;

- shall not be refundable under any circumstances

- shall not, under the indirect tax enactment or under any other Act:-

- be taken as input tax credit; or

(ii) Entitle any person to take input tax credit, as a recipient, of the excisable goods or taxable services, with respect to the matter and time period covered in the declaration.

(ii) In case any pre deposit or other deposit already paid exceeds the amount payable as indicated in the statement of the designated committee, the difference shall not be refunded.

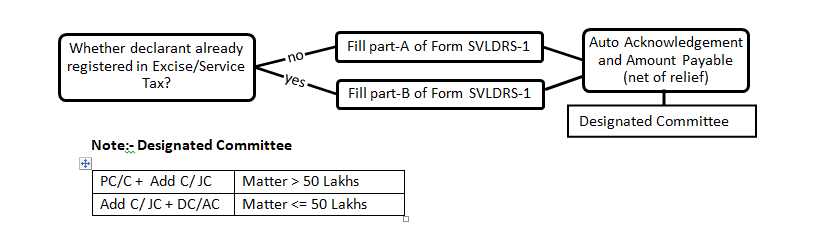

- How to Apply for SVLDRS, 2019…

- The taxpayer can apply for this scheme from https://cbic-gst.gov.in

- The taxpayer already registered under CE / ST can login and fill Part-B of SVLDRS Form-1.

- The unregistered taxpayer can register himself by filling Part-A of SVLDRS Form -1.

Declaration

Step 1:-