Section 194N – TDS on cash withdrawal in excess of Rs 1 crore

Brief Introduction:-

- FM Nirmala Sitharaman has presented her first Union Budget on 5 July 2019.

- The above section shall come into effect from 1st September, 2019.

- With a view to encourage digital payments and discourage the practice of making payments in cash, the Union Budget 2019 has introduced Section 194N for deduction of tax at source (TDS) on cash withdrawals exceeding Rs 1 crore.

- TDS deduction on cash withdrawal u/s 194N is applicable to all taxpayers other than some person.

What is Section 194N?

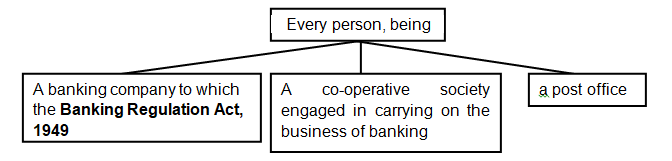

Every person, being-

(i) a banking company to which the Banking Regulation Act, 1949 (10 of 1949) applies (including any bank or banking institution referred to in section 51 of that Act);

(ii) a co-operative society engaged in carrying on the business of banking; or

(iii) a post office

who is responsible for paying any sum, or, as the case may be, aggregate of sums, in cash, in excess of one crore rupees during the previous year, to any person (herein referred to as the recipient) from one or more accounts maintained by the recipient with it shall, at the time of payment of such sum, deducts an amount equal to two per cent of sum exceeding one crore rupees, as per income-tax.

The section will apply to withdrawals made by taxpayer including:-

(a) Individual (d) Partnership firm or an LLP

(b) Local authority (e) Hindu Undivided Family (HUF)

(c) Association of Person or Body of Individuals (f) Company

Who is required to deduct TDS?

responsible for paying any sum or aggregate of sums in cash in excess of Rs. 1 crore during the previous year, to any person, deduct an amount equal to 2% of sum exceeding Rs. 1 crore.

When tax shall be required to be deducted?

TDS under Section 194N tax shall be required to be deducted only when the aggregate amount of cash withdrawal during the previous year by a person from one or more of his bank or post office account, as the case may be, exceeds Rs. 1 crore.

Rate of TDS:-

The payer will have to deduct TDS at the rate of 2% on the cash payments/withdrawals of more than Rs 1 crore in a financial year under Section 194N.

When tax shall not be required to be deducted?

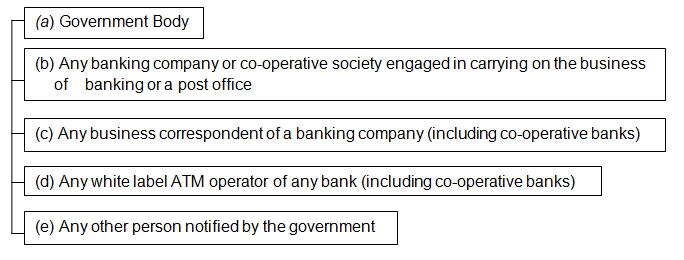

Tax shall not be required to be deducted if cash withdrawal from bank or post office is made by the following recipients:

PRESS RELEASE (30th August, 2019):-

Section 194N inserted in the Act, is to come into effect from 1st September, 2019.Hence, any cash withdrawal prior to 1st September, 2019 will not be subjected to the TDS under section 194N of the Act.

However, since the threshold of Rs. 1 crore is with respect to the previous year, calculation of amount of cash withdrawal for triggering deduction under section 194N of the Act shall be counted from 1st April, 2019.

Some Clarification:-

(i) If amount withdrawn from 1st April to 30th August 2019 is more than 1 crore than any amount withdrawn from 1st Sep 2019, TDS will be applicable.

(ii) Calculation of 1 crore should be bank wise and not branch wise.

Some Example:-

1- Mr. Shubham has withdrawn the following amounts from different branches of two banks 1st is UBI & 2nd is SBI whose amounts are

| UBI (Branch) | Amount (in lakhs) |

| A | 40 |

| B | 30 |

| C | 60 |

| SBI (Branch) | Amount (in lakhs) |

| A | 20 |

| Particulars | Amount(in Lakhs) |

| Rs 40 lakh from Branch A

| 40

|

| · R Rs 30 lakh from Branch B

| 30 |

| · R Rs 50 lakh from Branch C

| 60 |

| · R Rs 20 lakh from Branch D of SBI Bank

| — |

| · Total | 130 |

| · TDS (2% on above Rs.1 Crore) | (130-100)*2%= 0.60 |

2- Mr. Suresh has saving with a bank. The details of cash withdrawn from both the accounts are as follows:

| Date | Amount (in lakhs) |

| 15/5/2019 | 60 |

| 09/6/2019 | 20 |

| 01/8/2019 | 55 |

| 05/9/2019 | 20 |

In this case Mr. Suresh has withdrawn amount Rs. 135 lakhs before 1st Sep 2019 so any amount withdrawn from 1st Sep TDS at the rate 2% will be applicable. So TDS will be only

on 20 lakhs i.e. (Rs. 20000000*2%) Rs. 40000/-.

In second example if amount withdrawn on 1/8/2019 is Rs. 15 Lakh than TDS will be calculated on Rs. 15 Lakhs (Rs. 20 Lakhs-5 Lakhs) i.e. Rs. 30000/- (Rs. 15 Lakhs*2%).