Standard Operating Procedure to Be Followed In Case of Non-Filers of GST Returns (Circular No. 129/48/2019 – GST, Dated 24 December 2019)

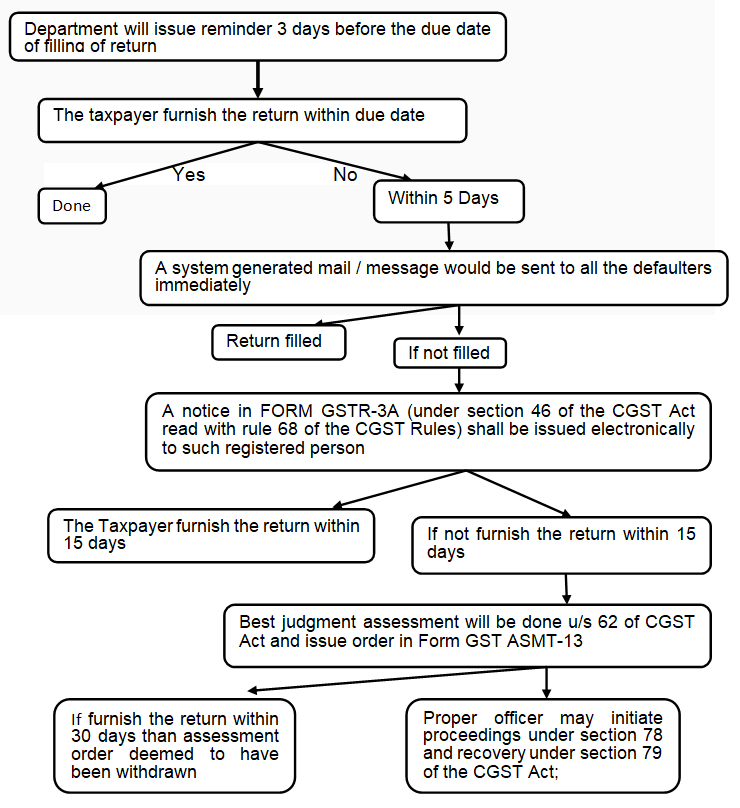

In case of non-furnishing of return under Sec. 39 or Sec. 44 or Sec. 45 of the Central Goods and Services Tax Act, 2017 (hereinafter referred to as the “CGST Act”). It has further been brought to the notice that divergent practices are being followed in case of non-furnishing of the said returns.

In order to clarify the issue and to ensure uniformity in the implementation of the provisions of the law across field formations, the Board, in exercise of its powers conferred by section 168 (1) of the CGST Act, hereby issues the following clarifications and guidelines.

Summarized circular of the same are explained as follows:

The proper officer would initiate action under section 29(2) of the CGST Act for cancellation of registration in cases where the return has not been furnished for the period specified in section 29.