GST Registration in India

GST stands for Goods and Services Tax. It is a comprehensive indirect tax levied on the supply of goods and services in India. GST was implemented in India on July 1, 2017, replacing multiple indirect taxes levied by the central and state governments, such as excise duty, service tax, value-added tax (VAT), and others.

The objective of GST is to create a unified and simplified tax system that reduces complexities, eliminates cascading effects, promotes ease of doing business, and fosters a common market across India. It is based on the principle of "One Nation, One Tax."

Applicability of GST Registration

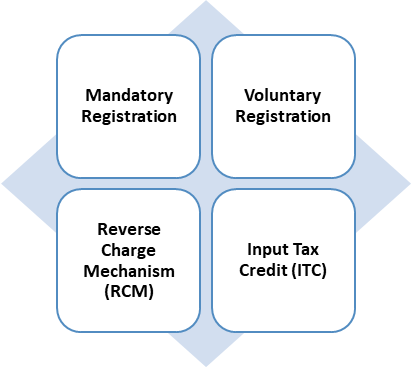

The Goods and Services Tax (GST) registration is applicable in India under the following circumstances: -

-

Mandatory Registration: GST registration is mandatory for businesses that meet any of the following criteria:

- Aggregate turnover: If your aggregate turnover (including taxable, exempt, and export supplies) in a financial year exceeds the threshold limit, GST registration is mandatory. The threshold limit is Rs.20 lakhs for most states in India (Rs.10 lakhs for special category states).

- Inter-state supply: If you are engaged in the supply of goods or services between different states, GST registration is mandatory, regardless of the turnover.

- E-commerce operators: Online platforms or e-commerce operators that facilitate the supply of goods or services must obtain GST registration, regardless of their turnover.

- Input Service Distributor (ISD): If you are an ISD, responsible for distributing input tax credit among your branches or units, GST registration is mandatory.

- Casual taxable person: If you are involved in occasional or seasonal business activities and do not have a fixed place of business, GST registration is mandatory, regardless of the turnover.

- Voluntary Registration: Even if your turnover does not exceed the mandatory threshold, you have the option to voluntarily register for GST. Voluntary registration can provide certain benefits, such as availing input tax credit, participating in inter-state transactions, and gaining credibility with suppliers and customers.

- Reverse Charge Mechanism (RCM): If you are liable to pay tax under the reverse charge mechanism, which occurs when the recipient is required to pay the tax instead of the supplier, GST registration is mandatory, regardless of the turnover.

- Input Tax Credit (ITC): To claim input tax credit on purchases, you need to be a registered taxpayer and possess a valid GST registration.

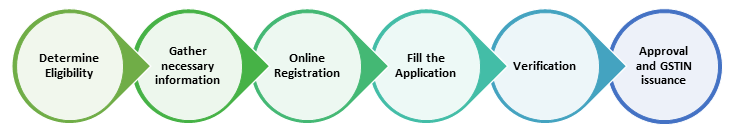

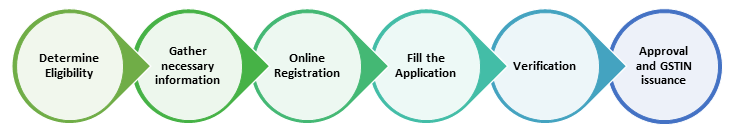

Process of GST Registration in India

To register for Goods and Services Tax (GST) in India, you need to follow the steps outlined below:

- Determine your eligibility: GST registration is mandatory for businesses with aggregate turnover exceeding the threshold limit, with most states having a 20 lakh annual turnover threshold (Rs.10 lakhs for special category states).

- Gather necessary documents: Gather necessary documents for registration, including PAN, Aadhaar card, proof of business registration, address proof, and bank account details, to ensure proper registration and documentation.

- Online Registration: GST registration is online through the GSTN portal at www.gst.gov.in requiring a service tab and clicking "New Registration."

- Fill the application: Complete GST registration form with business details, PAN, contact, bank account details.

- Verification: Submit application, receive ARN, and undergo verification by GST officer for additional information or documents.

- Approval and GSTIN issuance: Approval of application grants GSTIN issuance, a unique 15-digit number for registered taxpayers.

- Post Registration Steps: Update business systems with GSTIN for compliance after receiving it.

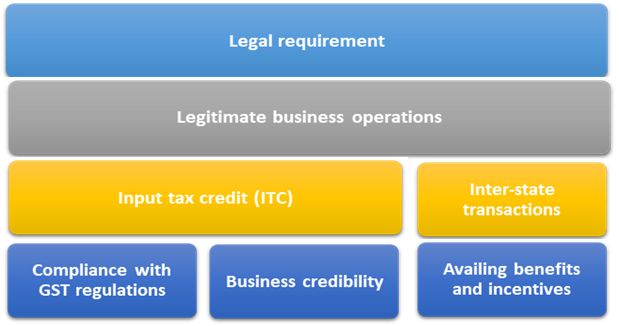

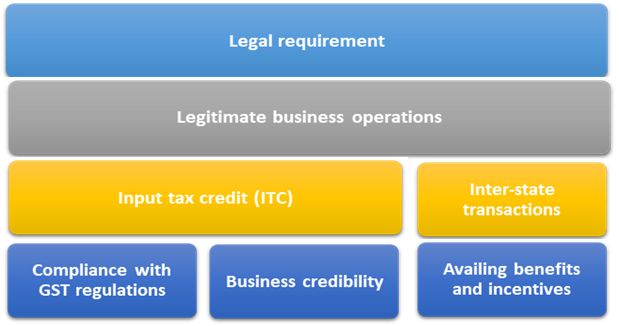

Why GST Registration is required?

GST Registration is required for several reasons: -

- Legal requirement: Mandatory registration for businesses exceeding threshold limit for GST (usually Rs.20 lakhs, or Rs.10 lakhs for special category states), avoiding penalties and legal consequences.

- Legitimate business operations: GST registration ensures legality and authenticity of business operations, recognizing it as a lawful entity.

- Input tax credit (ITC): ITC is available to registered businesses, allowing them to offset purchases tax against supplies liability, reducing tax burden and preventing cascading effects.

- Inter-state transactions: GST registration is mandatory for inter-state transactions, ensuring legal compliance and compliance.

- Compliance with GST regulations: GST registration ensures businesses comply with GST laws, including proper records, invoices, returns, and payment schedules, avoiding penalties and legal consequences.

- Business credibility: GST registration boosts business credibility by demonstrating compliance with tax laws and transparency, attracting customers and suppliers for input tax credit.

- Availing benefits and incentives: GST registration is essential for accessing government benefits, incentives, and schemes, such as composition schemes and export-oriented units.

Benefits of GST Registration

GST registration in India offers numerous benefits for businesses:

- Legally compliant operations

- Input Tax Credit (ITC)

- Seamless inter-state transactions

- Expanded market reach

- Competitive advantage

- Easy availability of input suppliers

- Access to government contracts

- Compliance with e-commerce platforms

- Simplified tax compliance promoting ease of doing business.

- Transition to the formal economy

Most applicable rate is 18% for GST, however there are other rates as well like 5%, 12% and 28%.

When are you required to get registered:

Turnover more than 20 Lakhs for services and 40 Lakhs for goods or if supply is made outside the state of supplier.

How can RAAAS help you:

- Checking applicability

- GST and non-residents

- Registration

- Modification in already registered units

- Advisory services on GST related issues

- Monthly calculations, payment and timely filing of returns

- Taking Input Tax Credits

- Compliance and regulatory consultancy

- Due diligence

- GST Annual Filings

- Structuring transactions to achieve optimizing costs

- Litigation matters

- Updating the client time to time about changes in the law