Understanding the Implications of Section 194T: A New Era in TDS Compliance

Introduction

The introduction of new TDS sections often signals a shift towards more intricate tax compliance requirements. The recent addition of Section 194T, set to become effective from April 1, 2025, is a case in point. Traditionally, TDS provisions were primarily concerned with payments to employees within firms, leaving payments to partners—such as remuneration, interest, and commissions—outside the purview of TDS regulations. However, Section 194T, as outlined in Clause 62 of the Finance (No. 2) Bill, 2024, extends TDS requirements to these previously exempt payments.

This article explores the implications of this new provision, highlighting the key changes and providing insights on how professionals and students can navigate the complexities of TDS compliance introduced by Section 194T.

Union Budget 2024 and Introduction of Section 194T

In the Union Budget of 2024, Finance Minister Nirmala Sitharaman introduced Section 194T of the Income Tax Act, 1961. This section imposes a requirement for Tax Deducted at Source (TDS) on certain payments made to partners of a firm, including salary, bonus, commission, interest, or remuneration. The goal of this provision is to enhance tax compliance and transparency in financial transactions within firms, covering both partnership firms and Limited Liability Partnerships (LLPs).

Everything About New TDS Section 194T

What is Section 194T All About?

Section 194T establishes a new framework for TDS on payments made by firms to their partners. Under this provision, any payment made to a partner—whether it is salary, bonus, commission, interest, or remuneration—will be subject to a TDS rate of 10% if the total amount paid within a financial year exceeds ₹20,000. This rule applies universally to all firms, irrespective of their size, thus broadening the scope of TDS obligations and increasing compliance requirements for firms of all scales.

Example:

Consider Seema, a partner in XYZ Associates. During the financial year 2025-26, Seema receives the following payments from the firm:

- ₹18,000 in June

- ₹22,000 in October

- ₹15,000 in March

Calculation:

- June Payment: ₹18,000 (This amount is below the threshold of ₹20,000, so no TDS is applicable.)

- October Payment: ₹22,000 (Since this amount exceeds ₹20,000, TDS of 10% is applicable on ₹22,000, which equals ₹2,200.)

- March Payment: ₹15,000 (Despite being below the threshold individually, this amount contributes to the total aggregate exceeding ₹20,000.)

Total Aggregate Payments: ₹18,000 + ₹22,000 + ₹15,000 = ₹55,000

TDS Calculation: Since the aggregate payments for the year exceed ₹20,000, TDS needs to be deducted on the total amount of ₹55,000.

- TDS at 10%: ₹55,000 × 10% = ₹5,500

Action Required: XYZ Associates must deduct ₹5,500 as TDS from the total payments made to Seema and deposit it with the government, irrespective of the individual payment amounts or the firm’s turnover.

New TDS Provision for Partnership Firms Under Section 194T

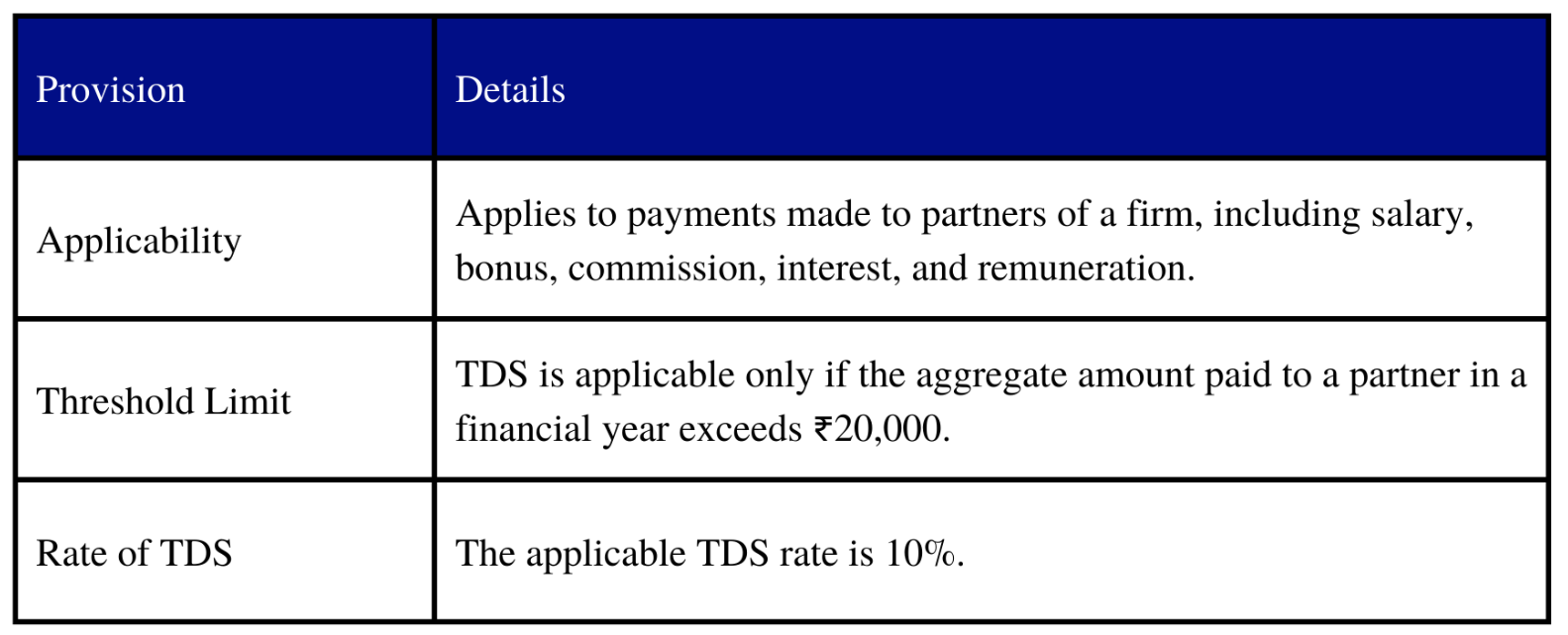

Section 194T introduces a new TDS requirement for firms concerning payments to partners. Here’s a detailed summary:

- TDS Requirement: Firms must deduct income tax at a rate of 10% on payments made to partners, including those credited to capital accounts. This deduction should occur at the time of crediting the amount or making the payment, whichever happens first.

- Threshold: No TDS is required if the total sum paid or credited to a partner does not exceed ₹20,000 within a financial year.

- Revised Limits for Partner Remuneration:

- First ₹6,00,000 of Book Profit or Loss: The maximum deductible remuneration is ₹3,00,000 or 90% of the book profit, whichever is higher.

- On Balance of Book Profit: Deduction is allowed at 60% of the book profit.

Implications:

- Compliance: Firms will need to update their processes to adhere to Section 194T, including integrating TDS deductions into payments to partners starting from the next fiscal year.

- Tax Planning: While the increased limits for deductible remuneration provide some relief, they do not fully alleviate the tax burden on partnership firms. Firms should plan their finances to align with these new regulations.

Key Provisions of Section 194T

Timing of TDS Deduction

Section 194T specifies that TDS should be deducted at the earlier of the following two events:

- At the Time of Credit: When the sum is credited to the partner’s account, including capital accounts.

- At the Time of Payment: When the payment is made to the partner, whether through cash, cheque, draft, or other modes.

This approach ensures timely TDS deductions, reducing the risk of tax evasion and delays in tax payments.

How the Limit of ₹20,000 is Calculated?

The ₹20,000 threshold is calculated as follows:

- Single Payment: If any single payment exceeds ₹20,000, TDS must be deducted.

- Aggregate Payments: If multiple payments are made, each less than ₹20,000, TDS is required if the total of such payments exceeds ₹20,000 within the financial year.

Example:

Consider Rajesh, a partner in ABC Enterprises, who receives:

- ₹12,000 in January 2025

- ₹8,000 in May 2025

- ₹7,000 in August 2025

Calculation:

- January Payment: ₹12,000 (Individually below the threshold but part of cumulative payments)

- May Payment: ₹8,000 (Cumulative payments now ₹20,000; still below the threshold individually)

- August Payment: ₹7,000 (Cumulative payments now ₹27,000)

Total Aggregate Payments: ₹12,000 + ₹8,000 + ₹7,000 = ₹27,000

TDS Calculation: Since the aggregate payments exceed ₹20,000, TDS needs to be deducted on the amount above the threshold.

- Amount Exceeding ₹20,000: ₹27,000 – ₹20,000 = ₹7,000

- TDS at 10% on ₹7,000: ₹7,000 × 10% = ₹700

Action Required: ABC Enterprises must deduct ₹700 as TDS from the total payments made to Rajesh and deposit it with the government, adhering to the cumulative approach of Section 194T.

Impact on Firms

Increased Compliance Burden

The enactment of Section 194T introduces a substantial compliance burden for firms, particularly affecting smaller entities. This new regulation mandates that firms obtain a Tax Deduction and Collection Account Number (TAN) and adhere to precise requirements for deducting and depositing TDS. The additional responsibilities necessitate rigorous record-keeping and strict adherence to compliance standards.

Capital Blocking

Section 194T’s requirement to withhold TDS at a rate of 10% on payments exceeding ₹20,000 could result in temporary capital constraints for partners. This deduction might affect their liquidity, especially if there are delays in receiving refunds. Firms must strategically manage their cash flows to mitigate the potential financial impact on their operations.

Applicability Date of Section 194T

The provisions of Section 194T are scheduled to take effect from April 1, 2025. This timeline allows firms adequate preparation for implementing the new TDS requirements. Companies need to set up the necessary systems and processes to comply with these updated regulations.

Difference from Section 192

Section 192 of the Income Tax Act deals specifically with TDS on salaries, applying only to income classified under the “Salaries” category. Payments made to partners are not included under this category, as defined by Explanation 2 to Section 15. These payments—such as salary, bonus, commission, or remuneration to partners—are not considered “Salaries” and thus fall outside the scope of Section 192.

Conversely, Section 194T addresses this gap by extending the TDS framework to cover payments made to partners of a firm. This provision ensures that various forms of income, including salaries, bonuses, commissions, and interest paid to partners, are subject to TDS. By introducing this section, the Income Tax Act now applies a 10% TDS requirement on such payments exceeding ₹20,000 annually, effectively addressing the omission left by Section 192.

Compliance and Record-Keeping: Recommendations

To comply with Section 194T, firms should:

- Obtain TAN: Secure a Tax Deduction and Collection Account Number (TAN) if not already possessed.

- Deduct TDS: Implement TDS deductions at a 10% rate on payments surpassing ₹20,000 from April 2025.

- Deposit TDS: Ensure timely deposit of the deducted TDS with the government to avoid penalties.

- File TDS Returns: Submit quarterly TDS returns that detail deductions and payments.

- Issue TDS Certificates: Provide partners with TDS certificates (Form 16A) as evidence of tax deduction.

Benefits of Section 194T

Although the new regulation introduces additional compliance requirements, it offers several benefits:

- Enhanced Tax Compliance: By extending TDS provisions to partner payments, Section 194T improves tax compliance and reduces the risk of tax evasion, thereby enhancing the overall transparency and reliability of the tax system.

- Broadened Tax Base: The inclusion of partner payments in TDS regulations broadens the tax base, increasing government revenue by ensuring more income is taxed at source.

- Promoted Financial Discipline: The TDS requirement encourages firms to maintain accurate records and adhere to tax laws, fostering better financial discipline.

Challenges and Considerations

- Administrative Burden: For smaller firms, the administrative demands of Section 194T can be significant. Investments in systems and additional resources may be necessary to manage these compliance requirements effectively.

- Impact on Liquidity: TDS deductions might affect the liquidity of partners, particularly if there are delays in receiving refunds. Both firms and partners need to plan their finances to address this issue.

- Awareness and Education: It is essential to educate firms about the new TDS provisions to ensure smooth implementation and compliance.

Conclusion

Section 194T represents a significant amendment to the Income Tax Act, designed to enhance tax compliance and expand the tax base. While it introduces new compliance challenges and potential liquidity issues for firms and their partners, it also ensures that income is taxed at source. Firms should prepare by establishing robust systems, obtaining TAN, and ensuring timely TDS deductions and deposits. With proper implementation and awareness, Section 194T can contribute to a more transparent and efficient tax system in India.

FAQs

1. What specific challenges might firms face when obtaining a Tax Deduction and Collection Account Number (TAN) under Section 194T?

Answer: Firms will need to ensure they apply for a TAN well before the implementation date of Section 194T to avoid last-minute complications. The process may involve providing detailed documentation, undergoing verification procedures, and ensuring compliance with all requirements set by the tax authorities. Firms may encounter challenges such as administrative delays, incomplete applications, or issues related to verifying the firm’s legal status. Additionally, smaller firms may find the application process particularly burdensome due to limited administrative resources.

2. How should firms adjust their accounting systems to accommodate the new TDS requirements under Section 194T?

Answer: Firms will need to update their accounting systems to track TDS deductions accurately. This includes configuring software to:

- Identify payments exceeding ₹20,000 to partners.

- Calculate TDS at the specified rate of 10%.

- Record deductions in compliance with the new regulations.

- Generate detailed reports for filing TDS returns and issuing certificates. Firms may also need to train their accounting staff to handle these new requirements effectively and integrate these changes into their existing financial processes.

3. What strategies can firms use to manage the potential cash flow impact due to TDS deductions under Section 194T?

Answer: To manage potential cash flow impacts:

- Plan Ahead: Firms should project cash flows considering TDS obligations to avoid liquidity crunches.

- Optimize Payment Timing: Schedule payments to partners to minimize the timing mismatch between TDS deductions and refunds.

- Maintain Reserves: Set aside funds specifically to cover TDS obligations, ensuring that adequate liquidity is maintained.

- Monitor Refunds: Keep track of TDS refunds and follow up with tax authorities if delays occur to manage cash flow effectively.

4. How does the introduction of Section 194T impact the financial reporting of firms?

Answer: Section 194T impacts financial reporting by requiring firms to:

- Reflect TDS deductions in their financial statements.

- Provide accurate disclosures regarding TDS liabilities and payments to partners.

- Ensure compliance with the new reporting standards, which may involve changes in how transactions with partners are recorded and reported.

- Include detailed information about TDS in annual financial statements, which may affect auditor reviews and financial audits.

5. What are the implications for firms that fail to comply with Section 194T requirements?

Answer: Non-compliance with Section 194T can lead to:

- Penalties and Fines: Firms may face financial penalties for failure to deduct, deposit, or report TDS correctly.

- Interest on Defaults: Interest may be levied on delayed TDS deposits, increasing the financial burden.

- Legal Consequences: Persistent non-compliance could result in legal action or additional scrutiny from tax authorities.

- Reputational Damage: Non-compliance can harm a firm’s reputation, potentially affecting its relationships with partners and stakeholders.