AMEDMENTS ALLOWED IN B2B INVOICE OF FINANCIAL YEAR-17-18 IN GSTR-1 OF JANUARY, 2019!!!

Here is the good news for return filers under GST!!!

Now, GST portal would allow amendments in B2B Invoices relating to Financial Year-17-18.GST portal has been

updated already to allow updation in B2B invoices of FY-17-18.

Those who were earlier worried about the wrong filling of GSTR-1 relating to FY-17-18 would now be relieved as they are

getting a golden chance of amending invoices ,debit credit notes, advances etc. relating to FY-17-18 in GSTR-1 of

January, 2019.

Here is the process explained for amendments to be made in B2B invoices of FY-17-18 in GSTR-1 of January, 2019:-

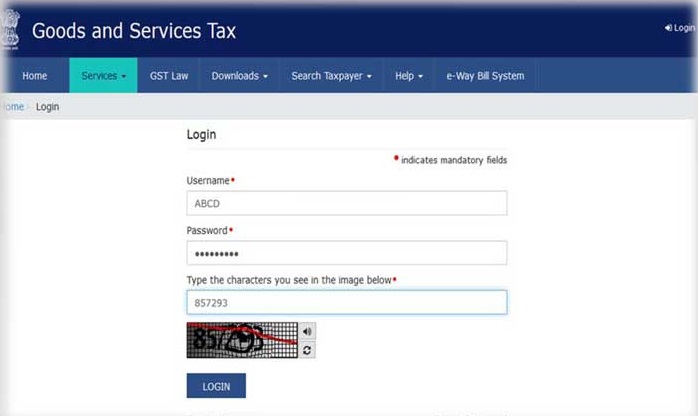

STEP 1-Login to GST Portal:-

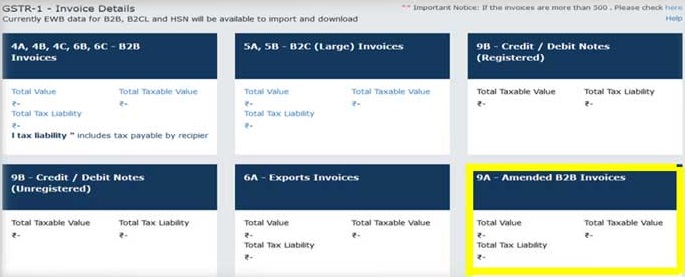

STEP-2:-Open GSTR-, a tab appears named as “9A-Amended B2B Invoice”

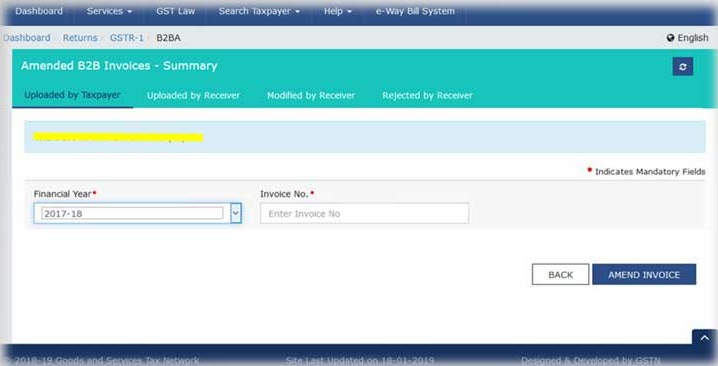

STEP-3:-Click on “9A-Amended B2B Invoices” .Following Window will Appear:-

Step-4:-Select Financial Year -17-18(for which amendment is required) and Enter Invoice number you want to amend and select “amend Invoic e” (as shown in above diagram)

Step-5:-Make necessary amendments in invoice and then click on “Save”

Congrats!!! Your Invoice has been amended once you file return.