Sole proprietorship is a type of business structure in which an individual operates and manages a business on their own, without any formal legal distinction between the business and the individual owner. In other words, the owner and the business are considered as a single entity.

In a sole proprietorship, the owner has complete control and decision-making authority over the business. They are personally responsible for all aspects of the business, including its profits, debts, and liabilities. Since there is no legal separation between the owner and the business, the owner's personal assets can be at risk in the event of business-related liabilities or debts.

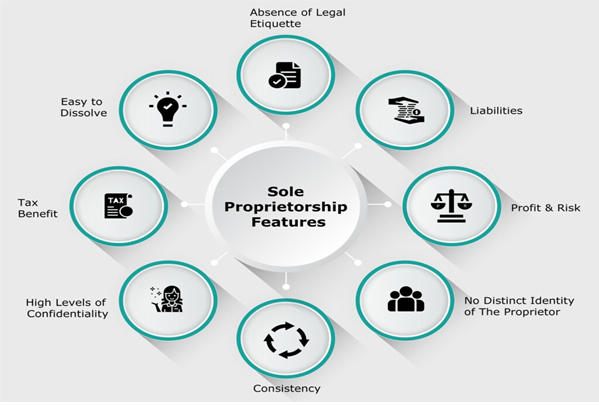

Features of Proprietorship firm

Sole Proprietorship Registration

A solo trader is run and managed by one individual. Furthermore, no legal agreement is required to create such a firm. On the other hand, a sole proprietor must include his trademark in any of the statutory actions that pertain to his business. A sole ownership firm formation is comparable to a certification under any state laws.

The following acts permit the establishment of a sole proprietorship:

You should discover and comprehend how to register yourself as a lone entrepreneur after becoming familiar with the characteristics of a single proprietorship. This will officially certify your company. The process of registering as a sole proprietor is quick and simple. You will learn how to start the registration process in the items that follow.

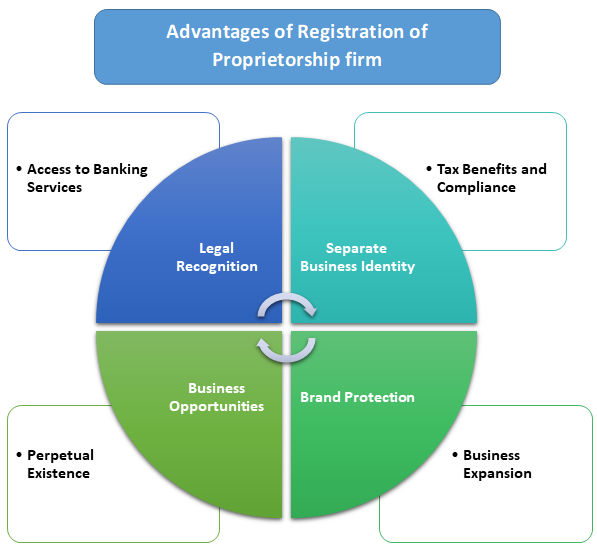

Advantages of Registration of Proprietorship firm

Registering a Proprietorship firm can provide several advantages, including: -

Here Resident individuals can start business in very basic form. That individual is the only owner of the firm. This is most simple and quick method of starting a business, especially where the individual wants the 100% ownership and a complete business privacy, startups can always experiment using this form of organization.

We can help you in registering the firm with required Authorities. With simply opening of bank account and some other basic things like an office space, letterheads, visiting cards, phone numbers, you can start the registered Proprietorship firm.

How we help you:

Once the registration is done, you can start your business. To further help you, we also provide a monthly package accounting system designed especially for small and medium sized business at very compelling prices and facilitating a designated contact person and monthly visits and reporting.

This enables you cut the cost since separate full time accountants are not required to be hired and also the compliances and reports are updated for a bird’s eye glance.